Yesterday, Donald Trump’s Treasury Department announced it was sanctioning three Mexican banks — Intercam, CiBanco, and Vector Casa de Bolsa — for money laundering activities on behalf of several Mexican drug cartels.

Based on an analysis by FinCEN (the Financial Crimes Enforcement Network within Treasury), which looked at transactions executed between the Mexican banks and Chinese companies, the U.S. Treasury Department claims the banks have laundered millions of dollars tied to fentanyl trafficking that it’s desperately trying to disrupt.

CiBanco was cited for laundering more than USD $12 million in cash from the CJNG, Beltran Leyva, and Gulf cartels, some of which was tied to fentanyl procurement from China.

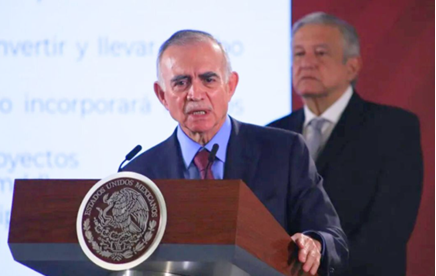

Vector, which is one of the top 10 securities brokers in Mexico, is controlled by Alfonso Romo, the former chief of staff to ex-president Andrés Manuel López Obrador, and was flagged as an even bigger player.

Though the announcement was light on specifics, Treasury cited one example of a Sinaloa cartel money “mule” (an employee whose job is to move cartel cash from the U.S. to Mexico) laundering $2 million through Vector Bank between 2013 and 2021. The bank is also cited for similar activities on behalf of the Gulf cartel, all of which Vector publicly denied.

Charges against Intercam Bank are similar, with cartel payments allegedly passing through their coffers valued at around $1.5 million. The bank has also denied the charges.

Mexico’s Finance Ministry has said that the U.S. has thus far provided no concrete evidence of the three banks’ involvement in money laundering for the Mexican cartels, even after it was asked.

How Could Sanctions Affect U.S. Citizens Living in Mexico?

Foreign residents in Mexico do a lot of international money transfers, and two of the three banks accused (CiBanco and Intercam) are popular with U.S. expats living here.

While not the biggest banks in Mexico, they are good-sized, and this move by the U.S. Treasury is likely to catch many expats off guard.

Intercam has 70 branches across Mexico, and is popular in expat-dense Baja Sur and Puerto Vallarta, while CiBanco has 13 branches, mostly in CDMX, Guadalajara, and Monterrey.

Though details at the moment are sparse, all dollar-based transfers originating in the U.S. to these three banks will likely be prohibited. The move effectively blocks these banks from activities within the U.S. financial system and will make it very difficult for U.S. account owners in Mexico to access their money.

It remains to be seen whether using a financial intermediary like Wise or OFX to move money between a U.S. bank and one of these sanctioned Mexican banks will be possible. But I’d be surprised if any of these firms is anxious to get in the middle of this fight and risk being frozen out of the U.S. financial system themselves. U.S. companies have already seen how vindictive Mr. Trump can be towards those who challenge his power.

If you have an account at either of these banks, I advise you to immediately begin looking for an alternative because this designation is unlikely to get rescinded quickly, as so many tariff threats have been. The order is set to take effect in 21 days from the date of publication in the U.S. Federal Register.

For safety, move your funds out of these banks before July 15, 2025.

Alternatives such as Spanish-owned BBVA (likely too big to sanction) and Nu Bank (a Brazil-based fintech startup) are worth considering. I use them both, and while they’re far from perfect, they get the job done.

I’ll provide more updates on this new threat to the personal finances of U.S. expats in Mexico when I know more.

The FinCEN order on Intercam can be viewed in full here.

Sources: Reuters, The New York Times, and ABC News