For expats, the future direction of the US dollar to Mexican peso exchange rate is a hot topic.

Virtually all of the predictions for a weaker peso by the end of 2023 turned out to be wrong (including mine). As a former Wall Street equity analyst and now an amateur currency analyst, I speak from experience… C’est la vie!

The Mexican peso finished 2023 on a high note against the USD, recording a 14% gain for the year when it closed a hair below 17 to the dollar.

US Dollar vs. Mexican Peso Performance in 2023

Will the peso keep rising in 2024 or fall back to Earth? Like it or not, what happens in the States has a large influence on what happens to the peso’s value.

While no one has a crystal ball, the factors that drove the peso to these heights against the USD are highly entrenched. They’re likely to continue supporting the peso in 2024, with perhaps only modest depreciation by year-end.

Let’s take a look at these factors now.

Factors Supporting the Mexican Peso

1. The interest rate spread between the U.S. and Mexico is large (5.25-5.5% in U.S. vs. 11.25% in Mexico), driving demand for pesos from global investors seeking to capture big returns.

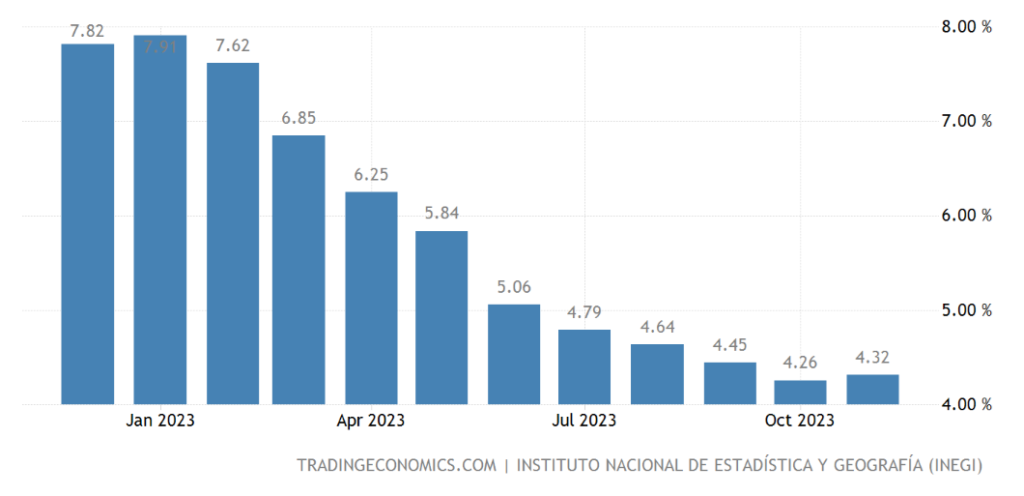

2. Divergent paths in the inflation fight. Mexico’s central bank (aka “Banxico”) said it intends to keep interest rates higher for longer to tame inflation (which was trending at ~ 4.66% in December, the second month in a row that it ticked higher). Banxico’s target inflation rate is 3%.

Mexico’s inflation rate came down a lot in 2023, but reversed course at year-end

Meanwhile, the U.S. Federal Reserve (aka “the Fed”) signaled at its last meeting it has likely reached the end of its tightening cycle, and may even start cutting rates in the next 3-6 months.

If Banxico holds while the Fed cuts, we’d see the rate spread widen between the two countries, further increasing investor demand for pesos. If the two countries’ central banks cut rates in a similar time frame, it would be a wash.

3. The “near-shoring” trend shows no signs of slowing. As companies continue to shift manufacturing into Mexico from distant hubs like China to be closer to the U.S. market and take advantage of free trade agreements, it drives demand for pesos.

Foreign Direct Investment into Mexico is believed to have hit a record in 2023, with receipts of $32.9 billion in the first nine months of last year, according to government data.

4. Strong remittances to Mexico from its citizens abroad stimulate peso demand as money flows from USD into the Mexican currency. As long as the U.S. economy avoids a recession these remittances will continue to flow at a high level.

BBVA estimates that total remittances to Mexico in 2023 increased 9% to a record $63.8 billion USD. These funds currently account for roughly 4% of Mexico’s GDP!

5. Higher oil prices stimulate Mexico’s economy (and government spending in particular). Historically, high oil prices have increased the peso’s value relative to the USD.

With high geopolitical uncertainty and ongoing hostilities in the Middle East, virtually all forecasts point to higher oil prices in 2024.

Factors that Could Weaken the Mexican Peso

The outlook for the peso this year isn’t all unicorns and rainbows. There are headwinds that could drive its value lower. Let’s examine a few of them.

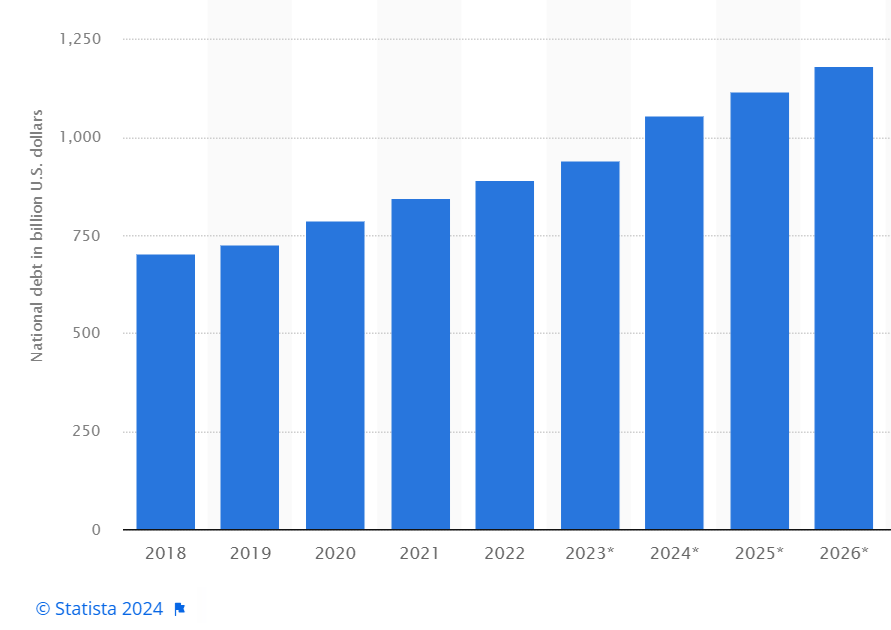

1. Mexico’s growing national debt, which is projected to keep increasing in 2024 due to large budget deficits, will put downward pressure on its currency as the government borrows more money to fund the shortfall.

Mexico’s growing debt burden, in billions of USD.

2. Banxico cuts rates sooner and deeper than the Fed (the inverse case of #2 above). If this scenario occurs it would narrow the rate spread between the U.S. and Mexico and reduce demnd for pesos.

This possibility strikes me as not very likely given the conservative monetary policies followed in Mexico coming out of the pandemic as compared to the Fed.

Unlike Mexico, which moved quickly to raise rates to fight inflation, the Fed reacted slowly to the inflation surge (claiming it would abate on its own), only to make very small rate hikes when it clearly wasn’t going away.

Now, the Fed appears to be signaling “mission accomplished” to the markets, despite core inflation still hovering around 4% (2x the Fed’s 2% target).

3. Mexico’s presidential election in early June. Mexico’s leadership change increases investor uncertainty about future economic policies.

Claudia Sheinbaum (above/at right), the former head of government of Mexico City (akin to governor of a big state like New York) and the Morena party nominee, is widely favored to win.

Even if the peso comes under pressure ahead of the election, the effects are likely to be short-lived, especially if Sheinbaum wins and there’s no change in the party holding Mexico’s highest office.

4. Re-election of Donald Trump to the U.S. presidency would increase uncertainty for U.S.-Mexico trade relations and likely put downward pressure on the Mexican peso (as it did in 2016, falling 12% overnight).

Despite current polling, it’s hard to imagine U.S. voters re-installing a person so obviously unfit to hold public office. But it’s possible.

From my perspective, this is the biggest wild card in 2024. A victory for Trump would be seriously destabilizing for the peso, and Mexico in general.

5. A surprise rate hike(s) by the Fed in recognition that inflation hasn’t yet been tamed. This move would take markets by surprise and increase demand for dollars. While I’m personally rooting for this to happen, it’s another low-probability event in an election year — but not totally outside the realm of possibility.

6. Oil prices fall, either in response to increased production by OPEC or due to decreased demand resulting from an economic slowdown in major industrialized nations. Though possible, the opposite is more likely in my view.

However you land on the arguments above, it’s worth noting the consensus expectation from a Citibanamex survey of 33 bank economists calls for the peso to fall more than 9% from its current level to ~ 18.65 pesos to the dollar by year-end.

Call me a skeptic on that one. Digging into the forecast, it’s based on the assumption that Mexito will begin cutting its benchmark interest rate starting in March 2024, presumably moving ahead of the Fed to cut rates.

That would be contrary to Banxico’s recent public statements and conservative stance over the past two years. In light of the stalled progress on bringing inflation down (recall that it was moving the wrong way at the end of 2023), lowering rates this soon undermines earlier efforts to bring price growth back to its 3% target, and risks re-igniting the inflation beast.

It’s worth remembering the experts were wrong last year in their forecasts for the Mexican peso.

As an expat who earns in dollars and spends mostly in pesos, I do hope I’m wrong and the peso gives up some of last year’s gains. As with any sound investment strategy, I’m hedging my bets.

We plan to take advantage of the wide interest rate spread favoring the Mexican currency for as long as it lasts. In an upcoming post, I’ll share details on how individual investors can capture some of these gains.