As expats know well, Mexico remains a cash-oriented economy.

According to the Federal Reserve Bank of Dallas, an astonishing 90% of transactions in Mexico (spanning retail, rent, services, utilities, and public transport) still get settled in cash.

This is huge when compared to the U.S. and Canada, where cash-based transactions have plunged in recent years to 25% and 33%, respectively.

As you’ll soon learn, there are good reasons that credit card usage (and ownership) remains quite small relative to the Mexican economy’s size and reach.

How Common is Card Ownership in Mexico?

The simple answer is … not very common.

As Mexico’s economy modernizes and both internet and mobile phone usage have skyrocketed over the past decade, persistently low credit card ownership is a bit puzzling.

As of 2022 (the most recent year that reliable data is available) approximately 11% of Mexicans owned a credit card. And that’s down from around 18% in 2014.

So, who has them?

Credit card ownership and usage in Mexico is primarily an urban “thing” with upwards of 80% of all credit cards here in the hands of those who live in cities, reflecting the lack of access to modern financial services in Mexico’s rural areas.

Additionally, wealthier households are far more likely to own a credit card than poorer ones.

According to the World Bank, there is also a substantial gender gap in card ownership in Mexico, with nearly twice as many men (15.1%) owning credit cards as women (7.7%).

Why is Card Ownership So Low in Mexico?

If you ask locals why so few of their fellow citizens own cards, the answer is typically something along the lines of… interest rates and fees are really, really high, while the customer service generally sucks.

On a practical level, credit cards aren’t handed out to anyone with a pulse the way they are north of the border. It’s actually kind of hard to get a general credit card, i.e. a card not tied to a specific retailer, if you aren’t formally employed in Mexico. (more on that in a future post)

Nearly 60% of Mexican workers have “informal” employment, with wages paid in cash. For these folks, it can be nearly impossible to access credit (or banking services at all), as their income is unverifiable and often unstable.

As my prior post on Mexican banks described, personal bank account ownership also remains low in Mexico due to distrust towards banks by locals (especially older generations) stemming from a rich history of banking scandals, fraud, and failures.

Plus, many Mexicans live in small towns and rural areas that lack easy access to banks.

And because bank account ownership is typically a precursor to getting a credit card in Mexico, these folks are effectively cut off from accessing credit.

Mexican Banks Don’t Exactly Roll Out the Red Carpet

Unlike more developed countries, banks in Mexico offer credit card holders few benefits.

For starters, there’s no cash back for purchases on a Mexican card and no cash rewards for signing up, like you commonly see in more developed countries due to intense competition between card issuers.

To borrow a phrase from one of my favorite old-school hip hop songs… Shit ain’t like that (in Mexico).

Mexico also provides minimal protections for borrowers. There are no laws limiting the amount of interest that can be assessed, so banks charge astonishingly high rates.

How high?

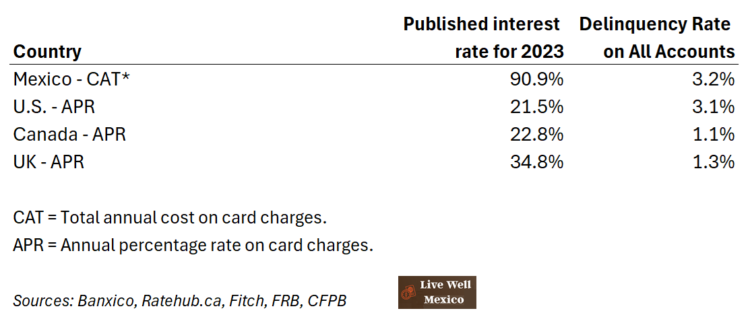

Mexico’s Central Bank published some research on credit card issuers’ CAT rates (similar to APR) last December and found that Mexican card issuers charged their customers anywhere from 47%-120% annualized on unpaid balances, not including annual card fees.

Incidentally, my bank BBVA offers a slate of cards with interest rates at the lower end of the spectrum (for Mexico) at “only” 77%. I think I’ll give those a pass!

These steep interest rates compare to an average of 21.5% for all U.S. credit cards in 2023, and 22% on card accounts in the U.S. carrying balances, according to Federal Reserve data.

Why is the rate spread so massive between the U.S. and Mexico?

Besides the lack of constraints on what Mexican banks can legally charge, the usual explanation is that delinquency rates are way higher in Mexico, so banks need to charge more to cover their risk.

That argument is now obsolete—because delinquency rates in Mexico have fallen precipitously in recent years, while interest rates have not.

Years ago Mexico’s delinquency rate on credit card accounts hovered around 15%, but as of 2024, it’s down to 3.2% — and nearly on par with the U.S. rate of 3.1%.

Incidentally, delinquency rates have been rising steadily in both the U.S. and Mexico over the past year, as inflation continues to pinch many household budgets. In response, these folks resort to putting more purchases on their cards.

The dramatic improvement in Mexico’s delinquency rates over the past decade shows that the vast majority of cardholders here are now using credit responsibly. It also may explain narrower card ownership versus a decade ago; as marginal users who got into trouble may no longer own cards.

Bottom line… The sky-high interest rates Mexican credit card holders suffer today appear to be more about bank greed than credit risk, abetted by a much less competitive banking sector in Mexico than in developed markets.

To summarize, these are the top reasons many Mexicans continue to avoid credit cards:

- Nosebleed interest rates on card balances not paid in full every month

- Annual fees for card ownership

- They can wreck a household budget if the user charges more than they can afford

- Getting reimbursed for fraud/unauthorized charges is not easy

Because of the numerous downsides with little upside, many Mexicans have opted to stick with cash.

Cash is Still King in Mexico

Besides locals’ longstanding distaste for Mexican banks, there are still a variety of advantages to using cash in Mexico. Paying in cash carries no fees or surcharges like credit cards often do.

It’s also fairly common to see retailers post two prices (a lower one for cash and a higher one for credit cards) or tell you at the point of sale what you can save if you pay in cash. This reflects retailers’ desire to push credit card fees onto consumers – not something expats from countries where cards are the dominant payment method are accustomed to seeing.

Europea, a store I shop regularly in Guadalajara for gourmet food and wine does this. And while the savings for paying in cash aren’t trivial, I still end up using a card most of the time because it’s impractical to carry around that much efectivo.

As a final note on the popularity of cash, many Mexican businesses prefer cash because it leaves no paper trail and is difficult to track, creating opportunities to evade taxes (and much more). This theory is born out by Mexico’s small share of tax receipts relative to GDP. At 14%, it’s low even by Latin American standards.

Where Are Credit Cards Accepted in Mexico?

Despite the low levels of usage, there are still plenty of Mexican businesses that accept credit cards for payment.

In big cities and tourist towns, major cards (Visa, Mastercard, American Express) are typically accepted in hotels, larg retail stores, and many restaurants, especially upscale ones. Discover is far less likely to be used or accepted here.

That said, when using smaller businesses, hiring contractors, taking taxis, paying tolls while driving, or shopping street markets, cards will get you nowhere. Bring the cash!

In my experience using credit cards in Mexico (foreign ones), it’s not uncommon for card transactions to fail at small businesses, or when trying to pay via a mobile processor. On the other hand, transacting at larger stores or in restaurants is generally pretty reliable.

And while most Mexicans shun credit cards, the time you’re most likely to see them used is for big-ticket purchases such as electronics or home appliances.

Some “Gotchas” When Using Credit Cards in Mexico

After two years of living here, I can share some lessons learned about using credit cards in Mexico.

If you bring credit cards to Mexico issued by a foreign bank, you will notice that some cards are better than others for expat living. Common surprises include:

- Foreign transaction fees on every purchase (typically ranging from 1% – 3%)

- Exorbitant currency conversion fees – if you transact in anything but MXN pesos at the point of purchase.

- Your card may be declined if you don’t notify the bank ahead of travel to Mexico, due to anti-fraud measures.

In an upcoming article, we’ll take a detailed look at how expats can get access to credit cards when living in Mexico.