These certainly are interesting times to be alive!

Every week lately has brought bombshell news that’s almost impossible to believe.

- Mexico’s first female president was elected in a landslide in early June.

- Up north a convicted felon who just survived an assassination attempt is running to be re-elected U.S. president. (and leading in polls)

- The unpopular current U.S. president withdraws from the race and endorses his vice president (a multiracial Gen X woman) for the Democratic nomination.

- Two of Mexico’s most powerful drug cartel leaders are captured on U.S. soil without a fight.

The firehose of unexpected news in North America has created a bit of chaos in currency markets.

Following an incredible run that prompted analysts to start referring to the Mexican currency as “the Super Peso,” it’s fallen nearly 10% against the U.S. dollar over the past two months.

Let’s take a closer look at the factors driving peso depreciation, and where things may go from here.

The Mexican Election in June

The Morena party’s victory in early June was no surprise (despite what you may read in the foreign press) but the margin of victory certainly was.

With Morena to hold a near-super majority of the seats in Congress in the upcoming term, AMLO (as the outgoing president is known) is keen to seize the opportunity to make structural changes to the federal government that move Mexico closer to autocracy.

AMLO has only one month of overlap with the new Congress and wants to make the most of it. In particular, AMLO seeks to fire the Supreme Court and more than a thousand appointed federal judges, replacing them with elected judges who can more easily be persuaded to support the ruling party’s agenda.

The proposed reforms will be taken up by the new Congress in August, with potential approval as soon as September. If judicial reform succeeds, it will cement AMLO’s legacy as anti-democratic. The reverberations are likely to be felt for years.

The increased political risk in Mexico spooked financial markets and led to a selloff of the peso in early June. Following a partial rebound late last month, the peso came under renewed pressure this month.

So, what’s going on now?

Nearshoring Trend Hitting the Skids

The widely anticipated $5 billion investment in a new Tesla Factory in Monterrey isn’t happening anytime soon. Elon Musk shocked Mexican leaders last week when he announced the project is on hold at least until the U.S. presidential election is over.

Pausing this one investment isn’t such a big deal for the peso – but the implications behind it absolutely are.

While Musk made a big deal of broadcasting his support for Trump following the assassination attempt a few weeks back, he’s starting to realize that a victory by the former Republican president may pose a threat to his business interests.

In Musk’s words, “I think we have to see what happens with the election. Trump has said he will put tariffs on vehicles produced in Mexico. So it doesn’t make sense to invest a lot in Mexico if that’s going to happen.”

The prospect of Trump’s reelection is a big wet blanket for the nearshoring trend that saw Mexico win a record number of new manufacturing investments in 2023 (totaling $36 billion), as global companies sought to reduce reliance on China by bringing production back to North America.

Alfredo Coutiño, director for Latin America at Moody’s observed in comments to AP, “This decision could be a warning signal for other large investors and could trigger new announcements of delays in investments in Mexico.”

Inflation in Mexico is Not Under Control – But Markets Don’t Seem to Care

New data released last week showed that consumer prices for the first half of July accelerated to 5.6% vs. 4.8% the prior month. It was the highest reading in 14 months, with food and beverages, as well as restaurant meals and hotels driving the number higher.

The more closely watched “core” inflation came in around 4%, and unchanged from the prior month.

Financial markets (which are dying for more rate cuts) took an optimistic interpretation of the numbers. Many argued the new data doesn’t alter their expectations for another interest rate cut by Mexico’s central bank in August.

When interest rates decline it causes a currency to depreciate as the inflow of foreign capital — chasing high returns – also declines.

Given worsening inflation this month I’m skeptical we’ll see another interest rate cut in August. Banxico (as Mexico’s central bank is known) is tasked with exactly one thing — price stability – and has been very strict in dealing with inflation since the pandemic.

Additionally, the Morena party’s recent track record of high government spending compared to historic levels (26.4% of GDP now vs. 24.7% over the past 10 years) helps to keep inflation high. And this isn’t likely to change as AMLO heads out and Claudia Sheinbaum steps in.

To summarize, if Banxico maintains interest rates at 11% over the near term it supports the peso. But because this isn’t the consensus view right now, the peso is under pressure.

The Mexican Economy is Slowing

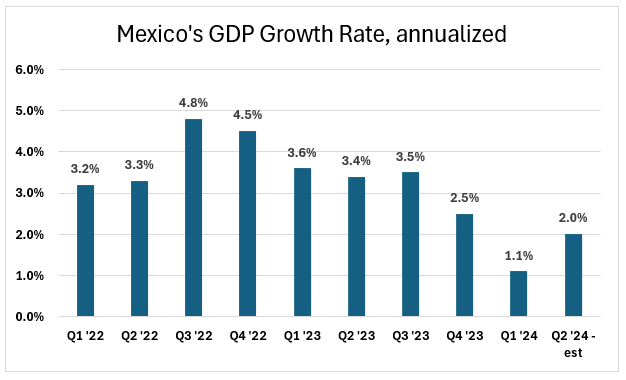

Recent reports from INEGI (the source of official government statistics in Mexico) show that Mexico’s economy decelerated for the sixth straight quarter. Retail sales in particular have stalled – contributing to the IMF’s decision to lower its outlook for the Mexican economy in 2024.

Slower economic activity in Mexico reduces demand for pesos.

Trump (again)

The former American president has been blustering about waging war against Mexico’s drug cartels if re-elected.

This radical, reckless, almost comical idea of attacking the U.S.’s neighbor, ally, and number one trading partner is raising the stakes in Mexico regarding the upcoming election. U.S. military action against Mexico would create chaos on multiple levels.

Separately, Trump has been threatening to slap a 10% tax on remittances to Mexico by its citizens living in the U.S. Since these money flows convert dollars into pesos, it’s a large factor that’s supported a strong peso in the past few years as the U.S. economy has run hot.

An exit tax on these money flows would be a huge blow to the Mexican economy, and one more factor driving reduced demand for pesos.

Currency Traders are Dumping Pesos

In response to the various risks described above, foreign exchange traders have been busy unwinding “carry trades”, i.e. selling pesos, over the past few weeks.

What’s a “carry trade” you ask?

I was first introduced to the concept when studying for the Chartered Financial Analyst (CFA) exam more than 20 years ago. The term refers to a speculative financial strategy that involves borrowing money in one country at a low interest rate and investing the funds in another country with a higher rate of return.

The investor’s profit is the difference between the two interest rates.

In recent years, currency traders used carry trades to bet heavily in high-yielding Mexican bonds, expecting peso strength to continue. Given the various new risks described above, these investments now have more risk, so traders are selling their peso investments, putting even more pressure on the currency.

What’s Next for the Peso?

Expats should expect the peso to remain under pressure until the US election is over. Until then, there will be no clarity on the future direction of U.S. policies toward Mexico.

Some analysts are calling for the peso to depreciate to around $19 MXN to the dollar over the next few months, and I agree that it’s possible.

How Expats Can Capitalize on Peso Weakness

For those who fund their living expenses in Mexico with dollar or euro-based assets, you probably already know that global money transfer specialists like Wise are a great resource for moving money into Mexico quickly and economically.

Besides one-off transfers, Wise also enables users to set orders to execute a conversion between two currencies when the exchange rate hits your desired level. For instance, if you want to convert dollars into pesos the next time the peso hits $18.5, you can set up an order to execute a specified amount when this “strike price” is reached.

While there’s no guarantee that your strike price will ever be hit, you don’t pay anything if no transaction occurs. So there’s nothing to lose.

Such transactions, dubbed “Auto Conversions,” can be executed in 24 currencies, including U.S. dollars, Canadian dollars, British Pounds, and Euros. The converted funds remain in your Wise account until you manually move the money to an outside account (this part can’t be automated, unfortunately).

Sources: FXStreet, Federal Reserve Bank of Dallas, INEGI, BNamericas, Politico