With Mexico’s residency visa fees expected to double in 2026 under the federal government’s newly proposed budget, the cost of relocating to Mexico keeps going up. For those experiencing sticker shock when checking Mexico’s 2025 requirements, it may be time to consider the alternatives more seriously.

For others, the value proposition Mexico offers relative to their home country may still be compelling. If you doubt it, please check out the myriad benefits of living in Mexico I wrote about here.

In a previous post, I compared Mexico’s residency requirements against two popular destinations in Latin America — Panama and Costa Rica. Today, I’ll take it one step further and look at how Mexico stacks up against two European favorites — Spain and Portugal.

Getting Residency in Spain as a Foreigner

Have you ever wondered what it’s like to live in a democratic socialist country? Spain offers you this chance — and I’m not trying to be sarcastic.

I’ve visited Spain a half a dozen times over the past 15 years and am in love with its high quality of life. Recently back from a trip to Madrid and Toledo, I cannot think of another European trip I’ve enjoyed more.

Besides plentiful sunshine, phenomenal food and wine, a community-minded joie de vivre, low crime, and rich cultural heritage, Spain offers residents top-quality, affordable health care. There’s also inexpensive and ubiquitous mass transit. And when you tire of one place, high-speed rail lines effortlessly whisk you from one city to another in less time than it takes to drive across town in Guadalajara, Mexico.

But in truth, residency visas in Spain are getting more restrictive lately. After a decade-plus of the Spanish government rolling out the red carpet to attract foreign residents, it’s been tightening the screws in 2025 due to a housing affordability crisis.

If you recall, after the Great Financial Crisis of 2009, triggered by the first housing bubble’s collapse, Spain’s economy also crashed hard, with unemployment hitting 25% and its property sector spiraling from excess speculation.

In a desperate search for economic stimulus, Spain introduced a Golden visa, which provided a path to residency via real estate purchases. Foreigners arrived in droves, and housing costs surged, with major cities like Barcelona and Madrid seeing massive inflation, pricing out many locals.

In response to intense political pressure, the Golden Visa is now history. In its place is the “Non-Lucrative” visa (NLV), or the “not working” visa.

Income Requirements for Foreign Residency in 2025

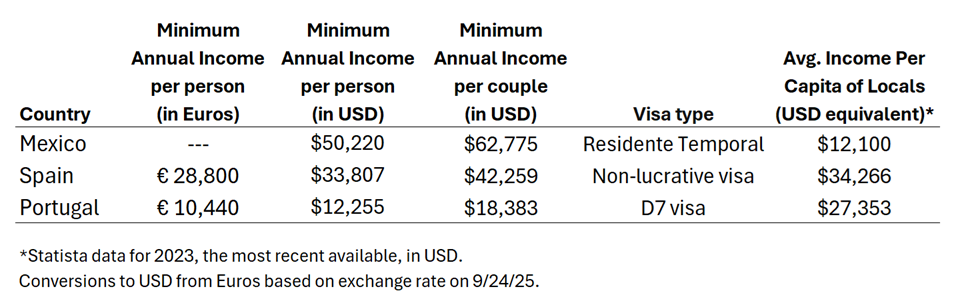

The NLV provides a path to Spanish residency via passive income for citizens of non-EU countries. For a couple, it takes 34% less income to qualify for the NLV than it does for temporary residency in Mexico.

Under the NLV, you cannot work for any company in Spain or work remotely for a company outside of Spain. Applicants are also ineligible for the NLV if they have any outstanding mortgages or personal loans abroad.

On the plus side, if you can afford to live in Spain without working, you can bring your family along with you.

In addition to meeting the financial requirements, you must also provide proof of private health insurance, as new residents are not eligible for the public system from the get-go.

If you still work, the Digital Nomad visa may be a better option. To qualify, you must prove that you have steady remote work with a non-Spanish company or clients, a minimum income of around €2,763 per month for an individual (about $3,245 USD per month), a clean criminal record, and private health insurance valid in Spain.

Why You Should Think Twice About Getting Foreign Residency in Spain

While I love Spain, if I’m being totally honest, there are pros and cons to becoming an expat in the land of sunshine, tapas, and Tempranillo.

For starters, Spain has a wealth tax, which averages 2% per year, and must be paid every year on the value of your worldwide assets. Spain is one of only three countries in Europe to impose a wealth tax (the others are Norway and Switzerland).

To use a simple example, let’s say you have a financial portfolio worth €1,200,000 Euros. It does not matter if these assets are located in Spain or in another country.

After the €700,000 allowance, the wealth tax on a €1.2 million portfolio would be €10,000 per year. This tax bill is on top of the income taxes due on any gains your portfolio had (figure at least 25% on those), with the stipulation that your total tax bill cannot exceed 60% for the year.

That’s a lot of dough to hand over to the Spanish government year after year, especially if you’re no longer working.

In addition to wealth taxes, Spain also imposes inheritance taxes on its residents. This tax applies to any money that might someday be bequeathed to you by a rich relative. (even when those assets are located outside of Spain)

The inheritance tax kicks in on any sum above a measly €15,957 Euros, assuming you’re over age 21 when you receive it and a direct descendant of the deceased. (if you’re not, the exemption is even lower) Depending on how much you inherit, the tax rate ranges from 7.65% to a brutal 34% on any amount over €797,000 Euros.

I can think of far better ways to enjoy a fortune than handing it over to Spanish bureaucrats. For the record, Mexico has no wealth or inheritance taxes.

So, how could you enjoy Spain but avoid becoming a “tax resident” of Spain? There are three key factors:

- Spend no more than 183 days per year in Spain.

- Derive the majority of your income from investments and activities in another country.

- Do not keep your primary residence in Spain.

These things may not be ideal, but are the price to be paid for living in a democratic socialist system with a high quality of life and a generous safety net. And if you’re someone who doesn’t have a sizable nest egg to worry about (or don’t care about keeping it), then Spain remains an excellent option to consider.

Getting Residency in Portugal as a Foreigner

The first time I ever heard of an American becoming an expatriate in Portugal was in 2017 while working for IHG, a multinational hotel company. A woman on the digital marketing team spontaneously moved to Lisbon, long before digital nomads were even a thing.

I thought it was a pretty badass move — and got jealous hearing about her European adventures while on work calls as she transitioned out of the company (100% remote work was not an option back then).

Eight years hence, Portugal has seen a massive wave of immigration, driven heavily by Americans in search of less stressful lifestyles in a country known for its vibrant culture, fresh food, excellent wine (plus Port!), and low crime.

As one of the poorest countries in Western Europe, Portugal is also attractive for its low cost of living, though that feature is much less compelling than it once was.

With respect to the financial requirements for residency, Portugal has one of the best deals going in 2025. As shown in the table above, a single person must provide proof of at least $12,255 USD per year in passive income to qualify for Portugal’s D7 Visa, which puts you on a path to permanent residency.

For a couple, the minimum increases to around $18,400 USD. This income threshold for a couple is an astonishing 70% lower than what is required to qualify for temporary residency in Mexico!

For D7 applicants, your income can be sourced from a pension, investments, or property rents. This visa allows the holder to work remotely from Portugal or start a business there, but it’s not possible to work for a Portuguese company with it.

As with the NLV in Spain, private health insurance is also mandatory to qualify for Portugal’s D7 visa.

The income thresholds for a D7 visa are consistent with Portugal’s minimum wage — so unlike Mexico, foreign residents are not expected to be well-off relative to the local population.

Another positive is that there are no wealth or inheritance taxes in Portugal (the latter was abolished in 2004). The government only imposes a flat 10% tax on the value of any inherited assets located within Portugal. If inherited assets are outside of Portugal, there’s no tax.

Despite the low income requirements, it’s worth noting that a significant portion of the newer foreign residents in Portugal do have means. This fact is evident from the explosion in housing costs in Portuguese cities popular with expats — most notably Lisbon, where rental prices have surged by 74% over the past five years alone.

So, while getting your foot in the door as a legal foreign resident in Portugal may seem easy relative to Mexico or Spain, a foreigner will struggle to afford a high-quality lifestyle in Portugal if their income does not exceed the mandatory minimum by a wide margin.

Once a foreigner has maintained five consecutive years of residency in Portugal, they are eligible to apply for citizenship. (it’s not automatically granted) To succeed, applicants must demonstrate basic Portuguese language skills, including reading, writing, and speaking at the A2 level, among other things.

To understand what a typical budget looks like for Lisbon in 2025, I’ll walk you through it below.

Cost of Living Comparison between Spain, Portugal & Mexico

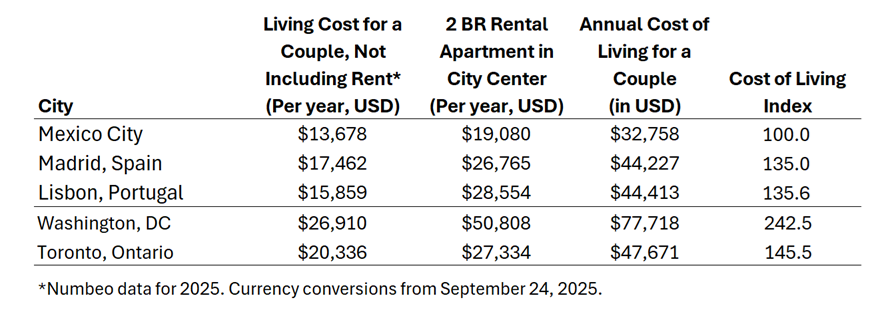

While Spain and Portugal have much lower income requirements than Mexico for legal residency in 2025, they both feature a higher cost of living. So it’s important to consider both factors when making a decision.

Below is the most recent data available from Numbeo on living costs in the three capital cities of Mexico, Spain, and Portugal, along with comparisons to Washington, DC, and Toronto, for good measure.

2025 Budget Comparison for Mexico City, Madrid & Lisbon

What I find interesting is that living costs in Spain and Portugal (viewed through the lens of Madrid and Lisbon) are very similar in 2025, despite average per capita incomes being 20% lower in Portugal. As you can see, exorbitant housing costs in Lisbon (due to strong demand alongside persistent supply constraints) are largely to blame.

As such, if you have your heart set on moving to Portugal and you don’t have significant resources, your best bet is to look in lower-cost cities than the capital, such as Porto or the resort towns along the Algarve. But for my money, quality of life is much higher in Spain — and now there isn’t really any cost premium there, if you can ignore the higher tax burden.

Regardless of where you choose, you’d still be saving big money relative to major cities in the U.S. and Canada!

Conclusion

While Mexico remains a powerful draw for American and Canadian expats due to its geographic proximity, vibrant culture, and lower cost of living, there are many viable alternatives out there for those who don’t meet the financial qualifications — or prefer a lower crime environment.

Coming soon, I’ll examine what’s in store for those seeking Mexican foreign residency in 2026, including those changing their status from temporary to permanent.