Everyone who owns real estate in Mexico (house, condo, or a piece of land) owes property taxes to their state government, aka the “impuesto predial.” These taxes are paid annually, during the first quarter of each year.

The predial is separate from the property acquisition tax, known by the acronym ISAI, which the buyer pays at the time of real estate purchase.

Unlike many tramites (official procedures) Mexican residents must complete, this one’s incredibly easy to get done.

When and How to Pay Mexican Property Taxes

Unlike many other countries, you will not receive a bill in the mail for your property taxes in Mexico. You are simply supposed to know your obligation and take care of it unprompted.

Since this may be a bit disorienting for new residents of Mexico, your best move if you owe predial taxes is to visit a government office to ask how much you need to pay.

What You Need to Bring with You

The first time you pay the predial in Mexico, you will be asked for your property address and a comprobante de domicilio (proof of address).

What they will accept:

- An official identification like your residency visa or passport (if not a resident)

- A bill from CFE (the electric utility) or Siapa (your water utility) no more than 3 months old. Note: the bill does not have to be in your name, it just has to match the address of the property whose bill you wish to pay.

Don’t bring an internet or cell phone bill from a private company as that normally won’t fly.

On subsequent trips, bring along the proof of payment from the prior year since it has all the relevant details they need to locate your account and process your new payment. In my case, I wasn’t even asked for proof of identity after showing the receipt from last year.

Where to Pay Your Property Taxes in Mexico

In Jalisco where I live, there are drive-through stations set up around Guadalajara in January to make paying the predial super convenient for those on the go.

If you don’t drive, another common venue for paying property taxes is a state government office. In my case, the most convenient spot to pay is next to the Basilica de Nuestra Señora de Zapopan.

But wherever you happen to be, your local city hall will accept these payments.

Once you’ve paid at least one predial to a Mexican government office, it’s possible to pay in subsequent years online. More on that in a minute.

Since I love visiting Mexican government offices (just kidding), I decided to pay my bill in person again this year. In truth, it was a good excuse to take a bike ride through historic Zapopan Centro and pay the bill at City Hall.

Proving that my smooth experience last year was no fluke, I paid my property tax bill this year in 8 minutes. It just goes to show that no native Tapatios think it’s a good idea to deal with property taxes on a sunny Friday afternoon.

In truth, it would have gone faster had I not taken the time to ask the nice bureaucrat a few questions about paying the bill online. I’d run into difficulty pulling up my account on the website after inputting my data various ways.

(I later discovered that I was attempting to transact on the webpage for Sinaloa property taxes instead of Jalisco’s.)

Now I know that each state (indeed each city) has a different web page for online payments, requiring different data inputs to complete the process. For anyone hoping to pay their predial online, be sure to Google the correct link for your city of residence!

If living in or around Guadalajara, use this form for online payments.

For residents of Mexico City start here.

In addition, the data inputs needed to pay online vary by municipality, and can only be found on your receipt from the prior year’s tax payment. This is par for the course in Mexican tramites. The only consistent thing is inconsistency.

How to Save Money on Your Property Taxes in Mexico

Mexican state governments are determined to get property owners to pay their taxes early, offering discounts to sweeten the deal.

While they vary by state and municipality, here in Guadalajara/Zapopan we can get a 10% discount for paying the predial before the end of February. If you wait until March (like most Mexicans) it goes back to full price.

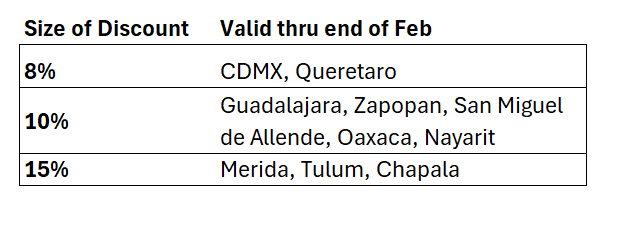

Below is a table containing the discounts available to predial taxpayers this month for cities popular with expats. In some cases, the discounts were double these rates if you paid in January.

There may be additional discounts available for senior citizens (with the INAPAM card) and persons with disabilities. Because these also vary by location, it’s best to ask for details in your local government office.

My Mexican Property Taxes by the Numbers

In pesos, our property tax bill in Zapopan rose 11% in 2025 from 2024 to $5,340 MXN (about $261 USD). The discount wasn’t a factor in the calculation as we received it in both years.

For context, we live in a 3-bedroom, 3.5-bath townhouse in an upscale section of Zapopan (west side of Guadalajara).

In U.S. dollars, our property taxes fell by 9% in 2025 due to the 20%+ decline in the Mexican peso’s value since last February when I paid our 2024 tax bill.

What’s more, our Mexican property tax payment in 2025 was 96% less than our last property tax payment in Colorado in 2022 (that bill was close to $6,000 USD).

In addition, U.S. property taxes have risen an average of 5% annually in recent years, while in Colorado annual increases have averaged 10.6% (!) since we left. If we were still living on the west side of Denver, we’d be looking at a property tax bill of about $8,100 USD in 2025.

In other words, by living and owning in Mexico, we have an extra $7,850 USD in our pockets this year. Viva Mexico!

Sources: State governments (Mexico), XE, CoreLogic