For those who follow the financial markets, today was one of those white-knuckle days. The Nasdaq entered correction territory (down 10%+ in the past 30 days), crypto cratered, and a 12% rout in Japan’s stock market represented the biggest one-day selloff in that market this century.

The U.S. dollar also continued its rise against the Mexican peso, touching 20 in the early morning hours, before settling back around 19.4.

Perhaps those crypto bros. who assured me earlier in the year that the U.S. dollar was doomed are feeling a bit less smug now that their alt investment has lost 20% of its value since July. But I doubt it.

For those in Mexico who spend in pesos but fund their lifestyles from dollar or euro-based accounts, days like today are a golden opportunity. By moving funds into pesos when your home currency sees breakout strength, you can effectively cut your living expenses in Mexico.

In the past month, the U.S. dollar has appreciated nearly 7% against the Mexican peso, while the Canadian dollar has risen 5% and the Euro has increased almost 8%. If you’re funding your day-to-day expenses on a fixed income, that represents a nice summer bonus for tostadas and margaritas.

But exchange rate volatility isn’t the only way to grow your savings right now.

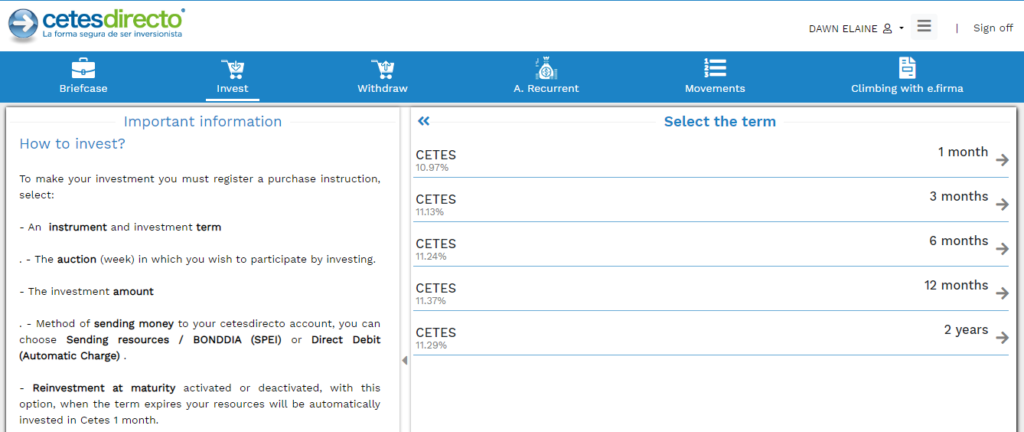

You can amplify the gains by taking any of those pesos you just converted that aren’t needed for living expenses, and investing them in short-term Mexican government bonds. While there are a variety of choices, one of the most popular is CETES.

CETES, or Certificados de la Tesorería de la Federación in Spanish, are Mexican federal treasury certificates, and the equivalent of U.S. Treasury securities. These bonds are typically auctioned by the Bank of Mexico every Tuesday and are available in a range of maturities, including one, three, six, and twelve months.

Known as “zero coupon” bonds, these securities are sold at a discount, with investors receiving the full face value at maturity, just like a U.S. T-bill. For this reason, you receive no interest payments on CETES until the bond matures, so holding them for the full term is essential to making money.

Foreign residents in Mexico (and citizens) are eligible to invest up to $23,000 MXN per month in CETES. With current rates in the ballpark of 11% these bonds represent a lucrative, safe, and easy way to invest any extra pesos you have lying around.

The 1-month bonds currently yield 10.97% annualized, while the 3-month bonds offer slightly more at 11.13%.

For more details on how CETES work and the best ways to buy them, see my previous post on the topic.

What You’ll Need to Make These Moves

To take advantage of these opportunities you will need:

- A Wise Account (or some other money transfer service) to convert currencies

- A cetesdirecto.com account to receive the funds

- A Mexican bank account to transfer funds to cetesdirecto.com (because foreign bank accounts aren’t valid)

It’s anyone’s guess where the peso goes from here, but my bet is on stabilization around 19 over the next few weeks, after today’s early panic driving the peso down to 20 didn’t hold.

Look to take advantage of any further weakness by setting up an order in your Wise account to automatically convert dollars (or whatever currency your source funds are in) into pesos. It costs you nothing and ensures that you capture these opportunities even if you happen to be sleeping — or out eating tacos.