Airbnb has been doing business in Mexico since 2011. Most people know it began as a way for locals to make extra cash by renting out a room in their home. More recently, investing in short-term rentals (STRs) has become big business, earning the wrath of many who see it as causing major dislocation in their neighborhoods and lives.

Setting aside the social ills short-term rentals may be causing in Mexico (which I examined in a previous article), how are these investments performing? As with most real estate questions, the answer depends on the location.

Some Mexican cities are still doing quite well, while others are struggling from excess supply and declining occupancy rates. Let’s take a closer look.

The Health of Airbnb in Mexico in 2025

According to ChatGPT, things are rosy for Airbnb owners in Mexico right now:

“Airbnb is performing strongly in Mexico in 2025, with high occupancy rates, rising revenues, and robust demand in major cities and tourist destinations. In Mexico City, the average Airbnb occupancy rate reached 68% between June 2024 and May 2025, with typical hosts earning around MXN 239,000 ($13,000 USD) annually.”

While it’s correct about Mexico City, you can’t trust everything you read on ChatGPT. (especially the free version)

Data from AirDNA (the industry standard) and Airbitics show a mixed picture across Mexico. Most locations are NOT seeing returns like Mexico City.

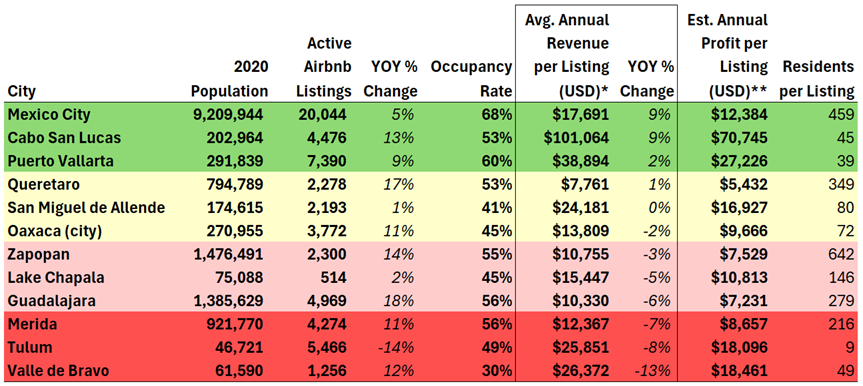

As with any real estate investment, it pays to do your due diligence. The table below shows how Airbnbs in popular locations are performing from a revenue and profit perspective as of August 2025.

Airbnb Performance in Popular Tourist Towns, August 2025

My analysis found that while some markets continue to be lucrative, others are oversaturated and seeing falling revenues and profits.

Healthy Markets

These cities are still enjoying revenue growth in 2025, but with each passing month, there are fewer and fewer of them.

Mexico City is having a moment, as anyone who’s been there recently can attest. It’s jammed with foreign tourists, who simply can’t get enough of its vast cultural riches, top-tier restaurants, charming tree-shaded plazas, and myriad festivals, concerts, and sporting events.

While listings are up 5% from last year, the average Airbnb occupancy rate in CDMX remains a healthy 68%, and revenues per listing are up 9% from a year ago to approximately $17,691 USD per year.

Aside from CDMX, owning an Airbnb in Cabo San Lucas looks like a license to print money. That’s assuming your property is nice enough to attract wealthy Chilangos (Mexico City natives) and Californians willing to pay top rates to vacation there. Average revenue per listing in Cabo is as good as it gets in Mexico, topping $101,000 USD annually, up 9% from a year ago.

Yes, the 1% seem to be doing quite nicely.

Puerto Vallarta, while not occupying the same rare air as CDMX or Cabo, is also still posting good numbers despite 9% growth in active listings this year. Revenue per average listing in PV is up a modest 2%, and occupancy is holding strong at 60%. Vallarta also boasts one of the highest average annual revenues per listing at nearly $39,000 USD.

Treading Water Markets

In these cities, Airbnb performance has stalled out, with virtually no revenue growth over the past year, due to weaker demand or increased competition from new rental supply.

Queretaro tops the list for a flood of new supply, up 17% year over year. Despite this huge uptick, revenue per average listing eked out a 1% gain during the same period. If supply continues to grow at a double-digit rate, I’d expect revenues to turn negative shortly. And given the already low revenue per listing ($7,761 USD annually) relative to real estate pricing in Queretaro, it hardly seems worth the trouble for a standalone unit.

San Miguel de Allende, while thankfully not adding new inventory, is seeing no revenue growth and weak occupancy trends at only 41% this year, suggesting it has all the Airbnbs it can handle.

Struggling Markets

These cities are facing a negative picture of declining revenue per listing, more competition, and, in some cases, weak occupancy rates, making many of the existing Airbnbs in these markets unprofitable.

Zapopan and Guadalajara, though still seeing healthy occupancy of 55% and 56%, respectively, continue adding new supply, which is pressuring nightly rates. Revenues in both markets are now declining at 3% and 6%, respectively. If I were the owner of a standalone unit here, unless my metrics were markedly better, I’d be looking to exit before the bottom falls out.

Merida is seeing a similar pattern to the Guadalajara metro region, but it’s under worse pressure from a revenue and profit standpoint.

Terrible Markets

And then there are Tulum and Valle de Bravo.

Tulum has a ridiculous Airbnb over-saturation problem, as the map above illustrates. Does any city really need one Airbnb for every nine residents!?

With supply outstripping admittedly high demand, Airbnb revenues in Tulum are under pressure, down 8% year over year, while occupancy has fallen to a subpar 49%. The good news is that many owners realize they’re on a sinking ship and are exiting in droves, with listings down 14% from last year.

At the bottom of the heap is Valle de Bravo — neither an international tourist destination nor an expat haven. The mess happening there is an entirely Mexican creation.

With occupancy rates averaging only 30% and revenue per listing in a free fall (down 13% year over year), it’s anyone’s guess why listings keep going up in Valle de Bravo. This isn’t going to end well.

Can anyone please give these rich folks some better investment ideas?

How is Tourist Traffic in Mexico in 2025?

Overall, U.S. tourist arrivals in Mexico fell by 2.2%, from 7.45 million to 7.29 million in the first half of 2025, according to new research from the Sustainable Tourism Advanced Research Center (STARC).

And for those still coming, there’s been a noticeable shift away from beach destinations to cities and cultural sites. Places like Cancun and Puerto Vallarta saw fewer foreign visitors than a year ago, while Mexico City is surging, especially among U.S. tourists.

These visitors are interested in more culturally immersive, educational experiences that can’t be satisfied at the beach, according to researchers at the Sustainable Tourism Advanced Research Center (STARC).

One exception to this overall trend is Guadalajara, Mexico’s second largest city, which saw tourism arrivals drop 2% in the first half of 2025.

It’s worth noting that Mexico’s Ministry of Tourism (SECATUR) more recently reported modest 1.7% growth in international air arrivals in the first half of 2025 versus the same period in 2024. At the same time, domestic air travel is up 4.5% year over year, suggesting Mexican tourists are critical to the industry’s current health.

Mexican tourists have not tired of the beach, as they’re increasingly visiting upscale resorts like Cabo San Lucas, but are also visiting archaeological attractions like Chichen Itza, a UNESCO World Heritage Site, and Teotihuacan, in bigger numbers than in prior years.

How Airbnb Owners in Mexico are Responding

As we saw in the numbers above, Airbnb owners in many Mexican towns are feeling the pressure and adjusting their strategy. Anecdotally, I’m seeing this play out in a few different ways. Some are:

- Converting their short-term rentals to long-term rentals, or

- Listing Airbnb properties for sale. (in some cases, while still on the platform)

How do I know?

I’ve seen Airbnbs I’ve stayed in featured in local expat groups as long-term rentals. I’ve heard Airbnb hosts say they’re converting an existing STR into an LTR due to fatigue from the non-stop “hustle.”

This is a strong signal that the returns aren’t what they used to be. Furthermore, I’ve seen properties posted for sale on social media that I recognize as former Airbnbs.

If I can see all of these Airbnb exits solely from personal experience, it’s likely the tip of the iceberg.

What Does the Future Hold for Mexican Airbnb Owners Who Stay the Course?

Those that stay in the STR market may face some lean years while things shake out. If Mexico heads into a recession over U.S. tariffs, we’d likely see lower demand from Mexican tourists as well, causing deeper pain.

But like any category of hospitality… Those who offer a superior customer experience will likely come out of this just fine. On the other hand, committing new money comes with increasing risk.

I’m hoping that Airbnb owners in Guadalajara who were seduced by “get rich quick” fantasies but never had much skill in hospitality exit the market swiftly.

Who are these guys? For one, the owner of a property we rented in Providencia, who couldn’t be bothered to arrange a way for us to access it on the first day of our reservation. And the owners of the house we stayed in on the south side of Guadalajara, who didn’t think it was a big deal to have a STR with no functioning locks.

While no one has a crystal ball, I strongly suspect we’re in for a couple of years of volatility in the short-term rental market, like we’ve not seen in Mexico to date.