Perhaps you’ve never imagined moving to another country to improve your finances (or living standard). But the fact is, you can. In this post, I’ll share how we’ve saved upwards of $4,800 USD per month by moving to Mexico from the U.S.

The concept behind this opportunity is sometimes referred to as geoarbitrage. For those of you thinking geoarbitrage must be some sort of trading strategy used on Wall Street—let’s set the record straight.

Geoarbitrage is simply earning money in a high-cost economy while living in a low(er)-cost one. The concept is based on the financial term—arbitrage—which means taking advantage of different prices for the same asset(s) in different markets.

Why would anyone go to such trouble?

For one, inflation has wreaked havoc on many a household budget over the past few years. Because it rapidly eats away at a currency’s purchasing power, inflation forces you to work harder or find ways to make more money — just to maintain your lifestyle.

It’s why many economists refer to inflation as a “hidden tax.”

And when inflation runs hot for extended periods like it has in much of the world lately — it triggers a cost-of-living crisis for those who don’t have much to trim from already lean budgets.

Geoarbitrage is one way to neutralize the worst effects of inflation.

Regardless of whether your income comes from remote work, a pension, or investments, the basic idea of geoarbitrage is the same. Live where your Dollars (or Euros or Pounds) can go a lot further.

The benefits of geoarbitrage include the ability to … pay off personal debt years faster, achieve financial independence years before traditional retirement age, pursue personal growth and new business ventures, or simply improve your quality of life.

How Does Geoarbitrage Work in Practice?

Domestic geoarbitrage is living and working within one country, e.g. working for a company based in New York while living in more affordable Philadelphia. Tons of people did this during the pandemic when 100% remote work policies were in vogue, escaping $5,000 per month rents.

International geoarbitrage involves two (or more) countries, e.g. earning wages from a U.S. company while living in Mexico. Later in life, it could be retiring to Mexico while living off of social security, a pension, or investment income from a high-cost country.

How We Made Geoarbitrage Work for Us

My first experience with geoarbitrage began back in 2010 when my husband Joe and I moved from the San Francisco Bay Area to Portland, OR.

The straw that broke the camel’s back was seeing a small and crappy two-bed/one-bath bungalow in our vibrant East Bay neighborhood sell for $720,000 during the housing bust of 2009.

Shortly after closing, the new owners (a young couple who had been renting in our building) began plowing even more money into their new dump to repair a cracked foundation.

My first thought was… I wish I also had a trust fund. And then… They’re 100% crazy.

Knowing we’d never be able to afford a home in Northern California that we actually wanted to live in, we resolved to pick up and start over in Portland, Oregon. We took our jobs with us (mine in digital optimization and Joe’s in engineering sales).

Choosing to move to a new place when the cost of living becomes too unbearable — or an obstacle to achieving your goals — is a hopeful act. It’s what people do when they aren’t content to let financial pressures overwhelm them.

So many 20- and 30-somethings at the time were leaving Oakland for Portland that we joked… Portland’s become Oakland’s Brooklyn. It was the height of Portlandia’s popularity.

After our move to Portland, we had reverse sticker shock. It felt like we’d gotten substantial pay raises, even though our incomes hadn’t changed.

The vast differential in housing costs between the Bay Area and Portland (back then the spread was something like 3:1) and the absence of retail taxes in Oregon versus 10% in CA, was liberating.

In Portland, we were finally able to buy our first home. And we began increasing our net worth, instead of continually running in place.

Geoarbitrage Experiment 2.0

Fast forward to 2020. We had moved twice more for job opportunities and were now living in Denver, Colorado.

We owned a home and three cars in an up-and-coming suburb on the west side. And while Denver area state parks, rec centers, and libraries were amazing, we were priced out of the city’s most central, walkable neighborhoods. (a lifestyle we loved and missed)

Despite our above-average incomes, the cost of living was rising so fast in Colorado that it reminded us of Northern California. Then the pandemic hit.

As non-essential workers, our worlds went remote. Non-stop Zoom meetings and Zoom “happy hours” were the new normal.

I was furloughed briefly because I worked in the corporate office of Vail Resorts, which was forced to shut down during the most lucrative month of the 2020 ski season.

Apart from being stuck at home, it was a strange time for other reasons. It seemed like everyone was moving to Colorado and the housing market was turbo-charged.

Big structural changes to the economy were underway, and with it came new opportunities to work from anywhere. Sitting on home price appreciation of more than 50% in less than 3 years, it felt like another housing bubble (i.e. a ticking time bomb).

With little attachment to a city we’d mostly experienced from home, in early 2022 we decided to sell our house in Denver, along with half of our possessions, and embark on our first international geoarbitrage experiment.

We weren’t Mexico neophytes.

Joe had lived in Mexico City as a child when his dad worked in the tire industry. As adults we’d toured Mexico City, Merida, Morelia, San Miguel de Allende, Ensenada, Oaxaca, Puerto Escondido, and Queretaro, and knew we’d like to live in this beautiful country someday.

We applied for and received temporary residency visas from the Mexican Consulate in Denver. Then we took the leap.

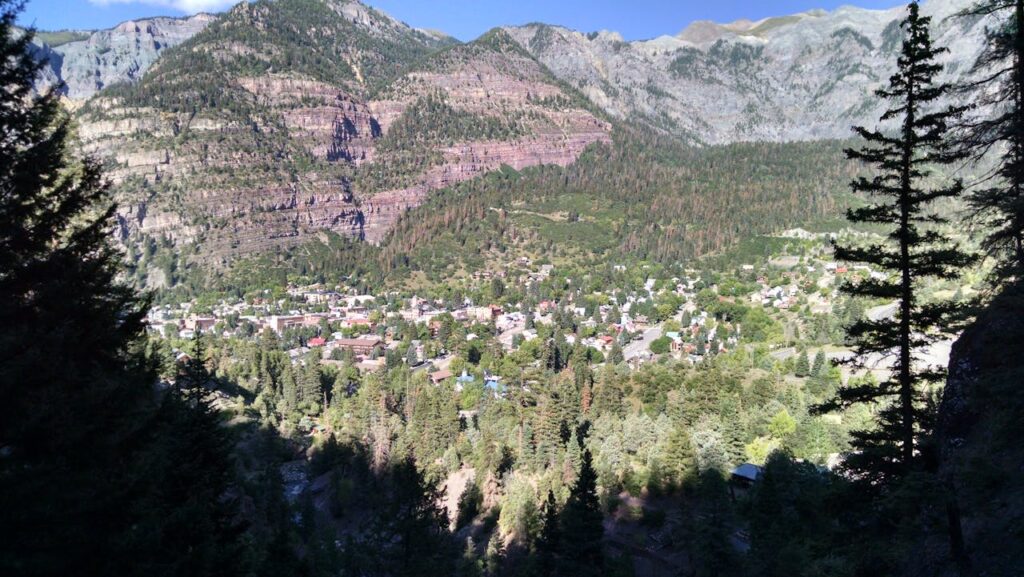

In search of a culturally rich city with a temperate climate and dependable airport, we chose Guadalajara. According to Numbeo, the cost of living in Denver was 120% more expensive than Guadalajara, with average rents in Denver roughly triple those in Guadalajara.

Numbeo said Denver held cost advantages in only two categories — Nike running shoes and mortgage interest (borrowing money at 11% is no bueno).

From first-hand experience, I now know that quality pet food and a decent bottle of wine will also hit your wallet pretty hard in Mexico. My recent post about stuff that’s stupid expensive in Mexico explains in more detail, if interested.

Cost of living aside, we’ve found Guadalajara a great fit. It’s a vibrant and sophisticated city with an almost perfect climate year-round. As I write this post in mid-January, it’s a sunny 75 degrees Fahrenheit outside, and our windows are open.

Guadalajara is home to film, music, and book festivals, a serious food scene, major universities, world-class health care, and parks with beautiful, old-growth trees. The expat community is diverse but not so dense as to overwhelm the city’s essence.

Using the proceeds from our house sale, we paid cash for a three-bedroom townhouse in a quiet, tree-lined, and walkable neighborhood in Zapopan (west side of the city).

Within 10 minutes on foot or bike, there’s a weekly tianguis (open-air market), restaurants, coffee shops, corner stores, movie theater, concert hall, pro baseball venue, light-rail line connecting us to the city center, and a new modern art museum about to open its doors. All the amenities of Mexico’s second-largest city are at our fingertips.

How Much Have We Saved Moving to Mexico?

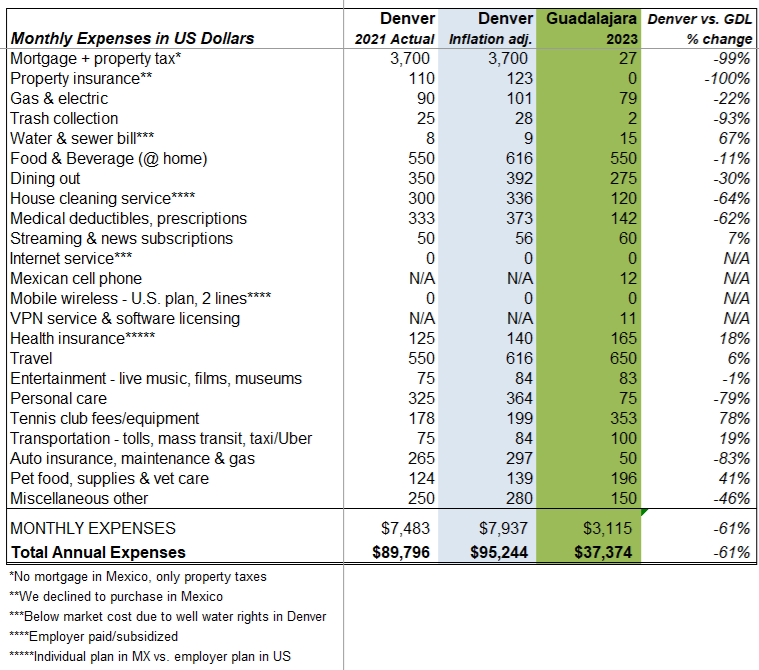

In our first full year in Guadalajara (2023), our expenses were 58% less than they were in Denver back in 2021, and 61% lower if Denver’s expenses are adjusted for inflation.

It’s the equivalent of $58,000 USD saved, including $44,000 less spending on housing-related items through ownership (with no mortgage) in Mexico.

Below is a comparison of our expenses in each city. The percent change calculation uses inflation-adjusted expenses in Denver (i.e. factoring in 6.2% growth over two years, with our mortgage unchanged because of a fixed-rate, 10-year loan).

Besides housing, other substantial savings have come from lower taxes and spending on various services, e.g. out-of-pocket health care costs, auto insurance/care, personal care, vet care, housecleaning, and dining out.

Those savings have allowed us to splurge on a few luxuries in Guadalajara that we never could have afforded in Colorado, like a private tennis club.

More surprising is that we managed these savings in a year where the Mexican peso appreciated 14% against the U.S. dollar, eroding the purchasing power of dollars compared to prior years.

Now, I would never recommend moving to another country purely for economic reasons. For this lifestyle to work for you, it’s important to be curious and adaptable, with a genuine interest in your host country’s language and culture.

In part 2 of this series coming next week, we’ll take a deeper dive into what it takes to be successful with geoarbitrage, and how to know if it’s a good fit for you too.