There’s no denying that Mexico has found itself in the crosshairs of its northern neighbor’s new leader. In his first few months back in office, President Trump imposed tariffs on various Mexican exports, rescinded them, then reimposed some tariffs a month later. He’s also threatened to use the U.S. military inside Mexico to strike the cartels.

His actions have triggered a financial market swoon and non-stop currency volatility. But despite the stress and uncertainty this has created for Mexico, I’m grateful to be living here as a foreign resident, where I feel somewhat insulated from the chaos engulfing my native country. The quality and cost of living in Mexico still greatly surpass what my husband and I could enjoy north of the border.

Before we dive into today’s topic, if this is your first time here, you may want to check out my previous article sharing a realistic monthly budget for a comfortable lifestyle in Guadalajara (where I’ve been based since 2022) or my cost of living comparison for 2025 for four popular expat destinations in Mexico, to get a solid foundation.

Below, I’ll examine how Mexico’s economy is faring in the early days of Trump’s return, and how living costs for U.S. and Canadian expats here have been affected lately.

Mexico’s Economy & Unemployment

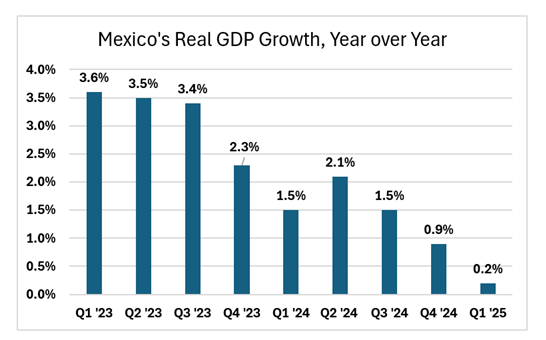

Mexico’s GDP slowed sharply in the first quarter of 2025 to 0.2%, just barely above water. The whiplash of Trump’s on, then off, then on again tariffs has started to disrupt supply chains, with manufacturing output taking a hit, services demand slowing, and cash remittances from overseas Mexican citizens to their families back home also dropping off.

One bright spot is Mexico’s unemployment rate of 2.6%, which stands well below U.S. unemployment of 4.2%. At the moment, it’s too soon to see a labor market impact from Trump’s tariffs. Looking ahead, the job market outlook is less good, as export-oriented manufacturers see increased order cancellations.

What’s more, foreign tourist arrivals in Mexico have been declining in recent months, a trend that’s likely to continue as more U.S. (and Canadian) households cut back on their non-essential spending. It’s a big deal because 9% of Mexico’s economy is tied to tourism.

That’s a quick snapshot of the big picture. Now, let’s zoom in on what I’ve observed in Guadalajara recently.

Price Changes I’ve Seen in Early 2025

Below are a few anecdotal observations of recent price increases:

- Plant and cow’s milk prices have surged, up ~ 20%+ at local grocery stores City Market and Chedraui.

- Our sports club, Atlas Colomos, raised its monthly fees by 10%.

- Dog and cat (dry) food prices spiked 13% and 28%, respectively, at my neighborhood vet clinic last month. Side note: Vet clinics are often a cheaper place to shop for pet food because they aren’t required to apply the luxury tax that retailers must.

- Our cable and internet provider, Totalplay, raised prices last month by nearly 7%.

On the other hand, there has been plentiful discounting on non-essentials:

- Fine tequilas and European wines have been 20%-50% off on selected bottles at City Market and La Europea for much of the spring season.

- Washing machines & dryers were 40% off recently on select Samsung models at Liverpool in March.

- Swiss watches (Movado, Rado, and Tissot, among others) are discounted 10%-40% at El Palacio de Hierro right now.

The widespread discounting on luxury and high-ticket items is telling because Mexican retailers normally follow strict and well-planned promotional calendars. Deviation from this script indicates economic distress.

As for tequila, the pain was self-inflicted by producers who got greedy. If this topic is a passion of yours (like many expats), check out my recent article here.

Regarding the other items, the unplanned discounting was likely due to some middle and upper-middle-class Mexican families cutting back amidst the unpredictable conditions created by Trump’s unstable trade and draconian immigration policies (which are big news here).

Mexico’s truly wealthy (which I’ll discuss in a future article) haven’t really been impacted yet.

Mexico’s Official Inflation Numbers

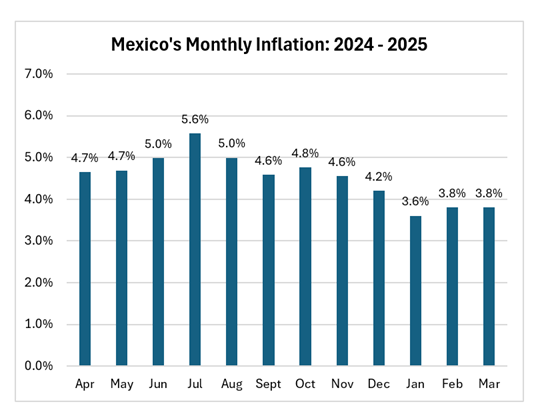

Personal observations aside, Mexico’s official inflation rate, as measured by the Consumer Price Index reported by INEGI, reinforces the pain many are feeling when shopping for everyday items lately.

After hitting a low of 3.6% inflation in January, prices in Mexico have begun to re-accelerate. The 3.8% increase overall in March (annualized) matched the 3.8% gain reported in February.

Fresh food prices have seen the biggest increases lately (+4.9% versus a year ago). Most notably, your tacos will cost more due to surging prices for limes (+21%), avocados (+7%), green tomatoes (+17.5%), and beef (+3%).

Price increases in services are also outpacing overall inflation, rising 4.4% versus a year ago. While this is a diverse category, prices for auto, health, and homeowner’s insurance have been seeing hefty double-digit gains in recent years, and above-average inflation is expected to continue through 2025. However, it’s worth noting that these costs are MUCH lower in Mexico than in the U.S., so increases aren’t a serious hardship for most.

Cushioning the blow in the food category as a whole in March were declines in the price of potatoes, onions, and eggs. Tortilla Española anyone?

Another bright spot for the month was energy inflation, decelerating to 2.7%.

Are Tariff Changes Impacting U.S. Goods Prices in Mexico?

On March 4, the U.S. imposed 25% tariffs on all imports from Mexico, with exceptions for USMCA (US-Mexico-Canada Agreement)-compliant goods. They were rescinded the next day, and then reimposed on Trump’s so-called “Liberation Day” in early April.

U.S. tariffs amount to a tax on American importers and consumers, not Mexican consumers. But they do harm Mexico’s competitiveness and can reduce demand for Mexican products from U.S. importers that don’t want/can’t afford to pay steep taxes on these goods, depressing trade between the two countries.

To its credit, Mexico hasn’t retaliated against U.S. tariffs, so there have been no price increases in Mexico driven by duties on U.S. goods. While President Sheinbaum has so far handled things well, in truth, she has little leverage given Mexico’s dependency on the U.S. market. (In recent years, the U.S. has bought more than 80% of Mexico’s exports)

Looking ahead, the wild card is where Chinese goods originally intended for the U.S. market will end up. Will we see a flood of cheap Chinese goods in Mexico as Chinese producers scramble to sell a mountain of stuff that U.S. retailers no longer want if a 145% tariff is slapped on them?

Beijing needs to find alternative markets in a hurry, and Mexican importers may strike some deals. In particular, Mexico buys a lot of Chinese consumer electronics, apparel, footwear, toys, sports equipment, and furniture. We may soon see even more.

Chinese cars are already everywhere in big cities like Guadalajara. But since they’ve never been allowed into the U.S. market, there shouldn’t be much change there. However, I do expect to see bigger deals on cars in Mexico going forward, as locals appear to be pulling back on purchases of big-ticket items in general, as noted above.

Incidentally, we’re planning to replace our U.S.-plated car with a Mexican-plated one later this year, and have begun seeing small discounts and 24-month free financing offers in Guadalajara. This stands in marked contrast to last year, when there were no deals whatsoever.

Dollar–Peso Exchange Rate Trend

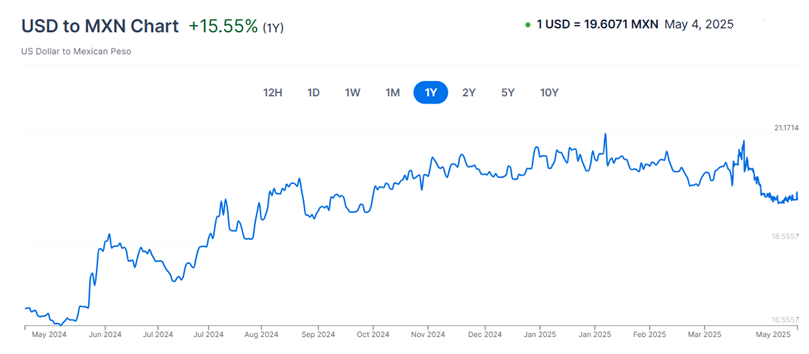

Exchange rates are a major bright spot for U.S. and Canadian residents of Mexico right now. Over the past 12 months, the U.S. dollar has gained 15.6% against the Mexican peso, while the Canadian dollar has gained 14.3%.

For expats in Mexico funding their living expenses with U.S. or Canadian dollars, currency appreciation this past year has successfully offset inflationary peso prices.

To illustrate, if your living expenses rose 3.8% in pesos while the U.S. dollar gained 15.6% against the peso over the same period, your real cost of living in Mexico is almost 12% less expensive (3.8% – 15.6%), assuming your income is in USD. Now this simple calculation ignores transaction costs and differences in what individual expats buy… but you get the idea.

To be clear, peso weakness lately isn’t entirely due to Trump — though it IS a big factor. Another reason came after Claudia Sheinbaum’s election last June. Her decision to move forward with AMLO’s (her predecessor) bad idea to turn judges into politicians by forcing them to stand for election — threatening to erode the rule of law in Mexico — has been a big drag on the currency.

Conclusion

Trump 2.0 has brought an end to boom times in Mexico for now. But I’d argue that U.S. and Canadian expats are still better off living here than in their home countries, where the cost of living is so much higher (with no currency benefits to soften the impact), to say nothing of Mexico’s better climate, culture, and comida.

Sources: INEGI, El Financiero, Trading Economics, XE