It’s a common practice with the expat community in Mexico to keep a foreign bank account(s) and make electronic transfers from it to fund a local account when cash is needed to pay living expenses. This raises the question of which money transfer service to use, because there are now quite a few to choose from.

It’s a topic I haven’t written about in two years, during which time the players and offerings have evolved. I myself began using Wise back in 2022, mostly because it’s so transparent and effortless, with most transfers completed in minutes.

More recently, however, I’ve noticed Wise is becoming less competitive in its transfer quotes relative to the competition. How do I know this? There’s another free tool called Monito that I’ve come to rely on to quickly compare transfer quotes.

Below, I’ll share a review of the top money transfer services for expats. But before I do, I’d like to start with some foundational knowledge on how these services work.

What to Look For When Selecting a Money Transfer Service

Let’s begin with a basic question. Why would you seek out a money transfer service in the first place if you already have bank accounts in the U.S. (or Canada) and Mexico?

Online money transfer services are so popular because they generally offer better exchange rates and lower fees than if you worked with your foreign bank directly to send money to Mexico. Traditional banks are known for layering on sizable fees and take a big margin for themselves on the exchange rate.

Are there exceptions? Yes, but those accounts typically require very large balances.

My theory on why traditional banks charge so much for international money transfers is that they aren’t a priority. Big banks have so many other ways to make money, which isn’t the case with money transfer services.

That said, there’s no single best money transfer service out there. The best provider for you depends on three things:

- How much you want to transfer

- How quickly do you need the money

- How you intend to receive the funds

I assume that everyone reading this cares about getting a good deal on their transfer. While I see this as a given, I’ll concede that some expats are more motivated than others to locate the very best deal.

Factors That Influence a Money Transfer Quote

From a client’s perspective, three key things influence the service provider’s quote. These are:

- The exchange rate offered, which reflects the margin taken by the provider

- The transaction fee applied to the transaction

- Speed of execution

With those factors in mind, I share my reviews of the leading international money transfer services below. These are based on my personal experience. And while I’ve now tried nearly all of them, as with everything in Mexico, your mileage may vary.

Comparing Money Transfer Services Available in Mexico

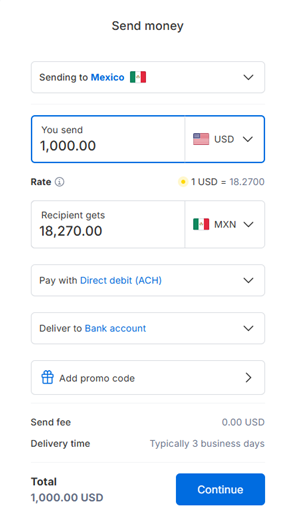

Before you head to any particular website, I suggest you start by doing a transfer quote comparison at Monito. This website doesn’t do the actual transfer, but aggregates offers across a wide range of money transfer services to find you the best deal.

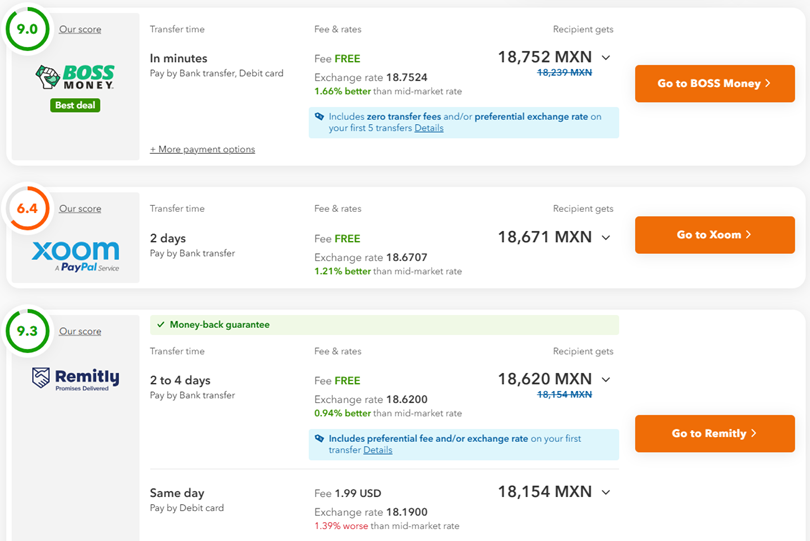

Below is what Monito’s results page looks like for an inquiry about transferring USD $1,000 to Mexico. Quotes vary by transfer method used.

Since I have a Mexican bank account and prefer to complete the transaction electronically, the screenshot below displays the three best options for a bank-to-bank transfer, but queries typically return at least six quotes.

As you can see, Monito showed that Boss Money (a service I was unfamiliar with) had the best transfer quote. Xoom was second best, but I’ll admit I was immediately turned off by their horrible 6.4 review score (and negative comments I’ve seen on Reddit).

Curious about Boss Money, I decided to check them out.

Boss Money Review

Boss Money offers three transfer options – bank deposit, cash pickup, and mobile transfer, with your first three transactions fee-free. When you become a regular user, transaction fees are a flat $2.49 USD.

That all sounded good.

To execute a transfer, you’ll need to download the Boss mobile app, as their website is solely for marketing purposes.

The first annoyance with this app was having to enter all of my personal data before verifying the transfer quote. In addition, it was necessary for the person receiving the funds to have a Mexican phone number.

This isn’t something that most other money transfer apps require. Senders were also asked to share their passport number, which I haven’t had to do with other apps. (though with new rules coming around remittances in 2026, you can expect this to change across the board)

Plus, in contrast to what I’d seen on Monito, the estimated transfer time shown in the Boss Money app for a bank-to-bank transfer was 3+ days. Figuring it was still worth it to try to secure their good exchange rate, I proceeded.

After configuring everything, my transfer request of $1,000 USD was rejected for being too big to be eligible for their promotional exchange rate (the rate I’d seen on Monito). So I tried it again, teeing up a $500 USD transfer to see if it qualified.

This time, it was accepted, only to be voided seconds later. Boss Money informed me via text message that my personal data could not be validated and my transfer had been cancelled. No details were provided on which item(s) caused the problem. Sheesh.

Besides the obvious problem that Boss Money didn’t work for me, I can’t recommend this app for two other reasons. The app’s low transparency around fees, combined with its demand for far more personal data than competing services (just to reach the quote page), were big negatives.

Remitly Review

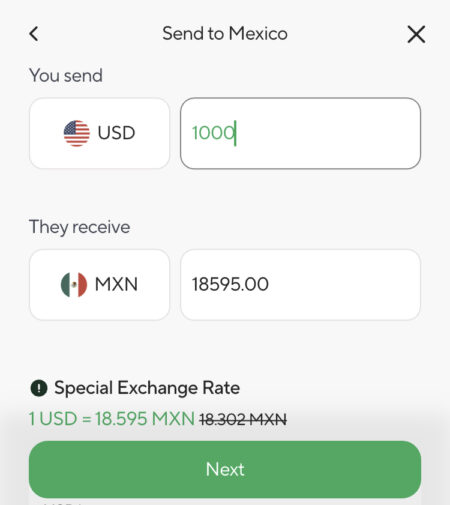

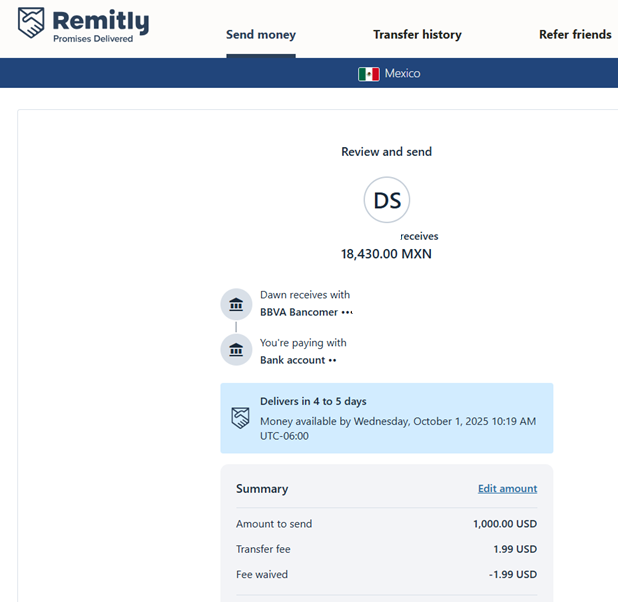

Remitly also offered a competitive quote, according to my Monito search. Like Boss Money, Remitly also charges a flat fee for transfers (it’s normally $1.99 USD). However, because I was a new user, I qualified for a free transfer out of the gate.

Their advertised execution time on bank-to-bank transfers is 4-5 days. Yikes, that’s a long time compared to Wise (where transfers are typically done in minutes)

Remitly’s payment methods are plentiful, and include electronic delivery to your bank, debit card, or mobile wallet, or for cash pickup at Elektra/Banco Azteca, BanCoppel, or 48 other locations. Note that cash pickup typically carries a larger fee of $3.99 USD.

One thing I noticed playing around with transfer sizes on Remitly is that exchange rates for small transfers (anything below $500 USD) are generally much worse. So it’s a good idea to send more cash less often if using Remitly.

My first transfer with Remitly went smoothly, and the funds arrived in 3 days, which was faster than advertised. There was no government ID required, and my source bank info was verified immediately with Plaid.

Customers can send up to $100,000 USD from the U.S. or up to $140,000 CAD from Canada with Remitly.

Best for: Those who send cash infrequently, those equipped to receive the funds electronically, and anyone not in too big a hurry to get their money.

Western Union Review

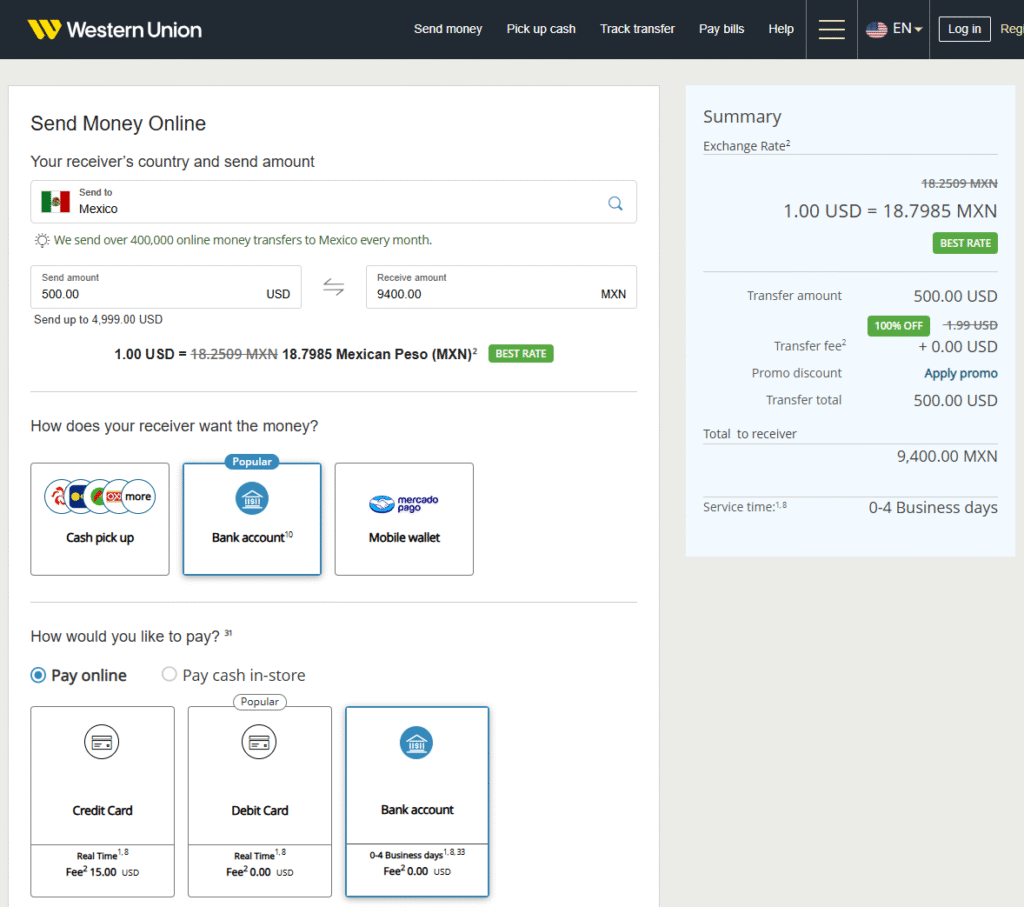

For a long time, I had this idea that Western Union was a low-tech, high-fee money transfer service that helps people send and/or receive small amounts of physical cash across borders. And while they do still handle cash transactions (that’s what their hundreds of retail branches across Mexico are for), my impression is outdated as WU’s services have evolved.

Western Union also now supports bank-to-bank transfers, bank-to-mobile wallet or cash pickup, and payments originating from a debit card, credit card, or Google Pay.

Like Boss and Remitly, WU also charges a flat fee ($1.99 USD) on transfers using most payment methods. That said, paying by credit card or with Google Pay carries a $15 USD fee. If you’re a new customer, fees may be waived depending on the transfer method you select. In my case, the fee was eliminated.

Western Union’s website is simple and intuitive to use on a laptop or mobile device. There’s also a mobile app, which I haven’t tried.

First-time users need to create a profile, which requires a mobile number for two-factor authentication. The recipient’s name and state of residence are required, but phone number and email address are both optional.

Like with Remitly, my bank account info was verified immediately by Western Union with Plaid.

Transfer time is advertised as 1-4 business days for bank-to-bank transactions, whereas transfers from a debit card, credit card, or Google Pay are completed in “real time,” which to WU means within minutes for 80% of users, according to their fine print. In my case, it took 5 days for my transferred funds to become available.

Best for: Those sending smaller sums of money. Anyone who lacks a Mexican bank account or mobile phone, and those seeking the very best exchange rates. You need to be patient if sending bank-to-bank — because transfers aren’t quick.

Wise Review

Like Boss, Remitly, and Western Union, Wise also offers bank-to-bank transfers and bank-to-mobile wallet transfers. They do not support cash pickups in Mexico, so this service is geared to digital natives with smartphones and/or local bank accounts.

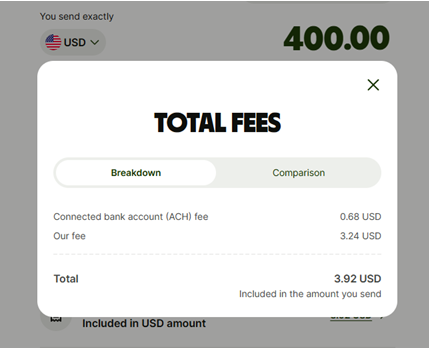

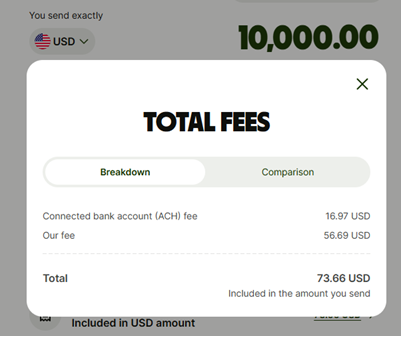

Another difference with Wise compared to other services is that its transaction fees are dynamic. In practice, Wise charges a higher percentage on small money transfers and lower percentages on larger ones.

To illustrate, below are a series of quotes from Wise captured on the same day and time at various transaction sizes. Wise’s fee percentage on a $400 USD transfer is 0.98%.

If the transfer is $1,000 USD, the fee drops to 0.83%. And for a transfer of $10,000, it drops even further to 0.74%.

But no matter how you slice it, all of Wise’s transaction fees top the flat $1.99 charged by Remitly and Western Union. The main reasons to use Wise despite the higher fees include same-day delivery of your funds and their support for larger transfers that competitors won’t handle.

With Wise, you can send up to $1,000,000 USD per wire. So it’s a natural fit for those living a champagne and caviar lifestyle in Mexico.

Best for: Those seeking safe, reliable, and fast electronic money transfers. Those moving larger sums of money and people who aren’t obsessed with getting the very best exchange rates.

XE Review

Xe wasn’t included in Monito’s transfer quote results, but I decided to check them anyway because XE is an established money transfer provider I’ve used in the past.

Like most of their competitors, XE supports transfers bank-to-bank, bank-to-mobile wallet, and bank-to-cash pickup. Besides sourcing funds from a bank account, payments can also be made from a credit or debit card.

Sure enough, on the day I tested it, XE’s quote for a bank-to-bank transfer was worse than Remitly, Western Union, Boss Money, and Wise, so I moved on. Because this isn’t always the case, I’d still check them before proceeding if finding the best transfer rate is important to you.

Like Wise, XE’s website and mobile app are super easy to use, break out the exchange rate and fee separately, and display quotes for various payment methods when toggled. There is no need to enter your personal data first.

All you have to do is create a free account to get started. And while I haven’t had the need, other XE customers mention the customer support team’s accessibility and willingness to resolve issues with minimal fuss.

Best for: Those seeking safe and reliable electronic money transfers. Those who want a high level of transparency on fees and exchange rates.

Other Money Transfer Options

Xoom: This is the money transfer solution from the folks who run PayPal. I am no fan of PayPal due to its high fees and lack of transparency on exchange rate margins. It seems that many others have the same opinion, judging by their score of 6.4 out of 10 from Monito users. The most common complaints include transfer delays and poor customer support when things go sideways.

OFX: This service is best for those making really large transfers, i.e., money for a property purchase, and those who want or need personalized support. From personal experience, it’s typically not that hard to get these guys on the phone. OFX’s rates are less competitive for smaller money transfers.

A bank ATM: For those who can get by on small sums and have no bank account in Mexico, the ATM is an excellent option, provided that you understand how to avoid those with large transaction fees and decline the Mexican bank’s conversion rate. Check out my articles here and here if you’re unclear on how to avoid getting ripped off at a Mexican ATM.

Just be aware that daily limits on ATM withdrawals in Mexico can be quite low (e.g., no more than $11,000 MXN, or about $592 USD, i.e., below what’s needed to fund an expat’s typical monthly rent payment in a major Mexican city.

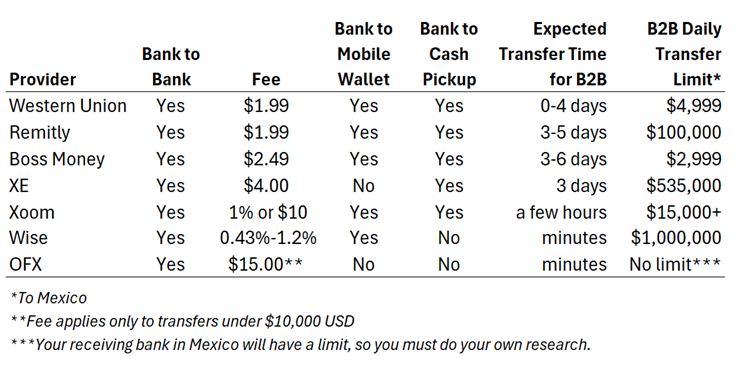

To wrap this up, the table below shows how the top money transfer providers compare on fees, payment methods, transfer time, and transaction limits.

International Money Transfer Service Comparison

If you transfer money with some of the services mentioned in this article, we may receive a small commission, at no additional cost to you. These partnerships help us to avoid using a paywall at Live Well Mexico.