Whether you’re a tourist visiting Mexico or an experienced expat, a dubious business practice the banking industry blandly refers to as “dynamic currency conversion” can cost you a lot in excess fees when shopping with a foreign credit card if you’re not careful.

Here’s how it works…

When buying something with a foreign credit card, a helpful salesperson may ask you if you prefer to pay in dollars (or whatever your home currency is) instead of the local currency, Mexican pesos.

Even though it may seem innocuous, the merchant is essentially trying to take advantage of foreign buyers who are inexperienced or intimidated by transacting in a foreign currency.

So, how does it hurt you? I’ll illustrate with a short story.

The Day I Fell Victim to “Dynamic Currency Conversion”

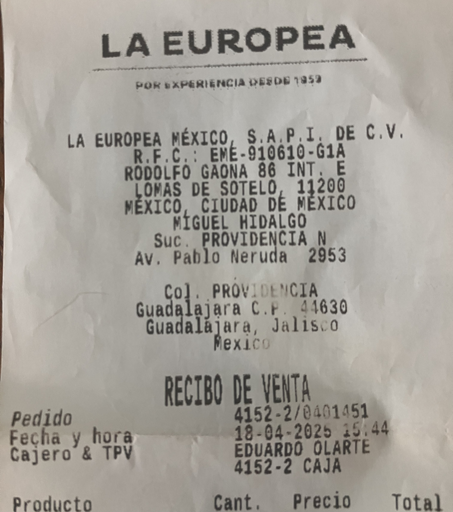

My husband and I had stopped into the fancy wine and food emporium La Europea in Guadalajara over Easter weekend. It’s a store I shop at least once a month, so my guard was down.

There were a plethora of deals that day, so we were stocking up on adult beverages and gourmet food items. We were speaking to each other in English at the checkout counter when something unexpected happened.

As the cashier was ringing up our purchase, I noticed him quickly tapping the terminal (as hand-held credit card readers are called in Mexico) a series of times without saying anything — until it was time for my signature. I didn’t think twice about it.

When I received a transaction confirmation by text from my credit card company later that day, something looked off. The charge was much higher than it should have been, given the day’s exchange rate (which I regularly track).

My bank normally converts foreign purchases pretty close to the daily spot (market) rate. But examining my receipt, the total had been $4,065 pesos on a day that the peso/dollar exchange rate was around 19.7 to 1. Yet the amount posted to my Visa account in USD was $222, implying an exchange rate of 18.4 pesos to the dollar.

Ugggh. This is when I realized the cashier must have selected “pay in dollars” for my purchase without asking for my permission.

The impact? I paid an 8% commission on my purchase at La Europea, or roughly $16 extra dollars!

Sheesh.

To be clear, most cashiers probably have no idea how that small decision financially impacts the consumer — but their boss certainly does!

While I got DCC’d in Guadalajara, you should understand it can happen to anyone shopping anywhere in Mexico with a foreign credit card. Based on my research, I’ve learned this practice is also common in Europe, with major banks in some countries requiring businesses accepting credit cards to offer consumers the choice.

What’s worse, if your credit-card issuer also charges a foreign-transaction fee on your purchases, they’re likely to add it on top of the junk fees the local merchant charged you.

How To Protect Yourself from Dynamic Currency Conversion While Shopping

According to Visa and Mastercard policies, consumers have the right to decline DCC “service” whenever it’s offered.

If a restaurant, hotel, shop, or other business establishment in Mexico asks if you prefer to pay in dollars (or another foreign currency) instead of pesos, politely but firmly refuse with a “no gracias.”

Sometimes, a merchant will hand you the terminal with both the Pesos and Dollar prices displayed side by side. In this case, always tap the MXN peso price.

Other times (especially in expensive restaurants where there are lots of foreign diners), you may be handed a bill with two totals displayed, one in the local currency and the other in U.S. dollars. In this case, circle the amount in MXN pesos before signing the bill.

Think of this choice as similar to the step you’ll see at a Mexican bank’s ATM, where you can accept or decline the conversion rate (always decline it to avoid a similar fleecing) before receiving your cash.

What to Do if You Are Duped into Dynamic Currency Conversion

If the merchant rings up your foreign purchase in dollars without asking your currency preference, ask them to reverse the charge and ring it up again in pesos.

If they refuse, then mark the receipt “local currency not offered” and warn the clerk that you will be disputing the charges with your credit card company.

Side note: It’s not common for a store in Mexico to give you a refund when there’s a problem with your purchase. Mexican business culture is oriented around protecting sellers’ interests, not the customer.

Similarly, if you were pressured to accept payment in a foreign currency instead of the local one, dispute the charge with your card issuer. Be sure to provide the original receipt showing the merchant’s name, location, contact information, and the amount charged in dollars.

Your bank will initiate an investigation and – in the best outcome – refund you the excessive fees and/or charge them back to the merchant who ripped you off.

If you decide to go that route, the downside is that dispute resolution can drag on for months. But it’s worth attempting to keep these merchants honest when they seek to rip off buyers paying with foreign cards.

Of course, if you were offered the choice of your home or local currency and chose your home currency, there’s no basis to dispute the excess charges. Chalk it up to “expat education” and be more attentive the next time you pull out a foreign credit card in Mexico.