When I first wrote about investing in Mexican government bonds (aka “CETES”) earlier this year, yields were sitting above 11%. That was a phenomenal opportunity to generate strong passive income with very low risk.

So what about now? Are CETES still a good place to invest your spare cash following two rate cuts and the peso’s wild ride this past summer?

Before we dive into this topic, let’s do a quick refresher.

What are CETES?

CETES, or Certificados de la Tesorería de la Federación in Spanish, are Mexican federal treasury certificates, and the equivalent of U.S. Treasury securities.

CETES are typically auctioned by the Bank of Mexico every Tuesday, and available in a range of maturities, including one, three, six, and twelve months.

Known as “zero coupon” bonds, these securities are sold at a discount, with investors receiving the full face value at maturity, just like a U.S. T-bill.

For this reason, you receive no interest payments on CETES until the bond matures, so holding them for the full term is essential to making money.

Plus, there are tight restrictions on how much you can buy per month, so if you’re starting from scratch, it will take time to build up this income stream.

To learn more about who’s eligible to invest in CETES bonds and where to buy them, check out my previous post on this topic.

Current CETES Bond Yields

As of September 20, 2024, CETES bond yields are as follows:

For comparison purposes, let’s look at current yields on U.S. Treasuries:

What’s Changed Over the Past Six Months

Four events have had a significant impact on Mexican investors during the past six months.

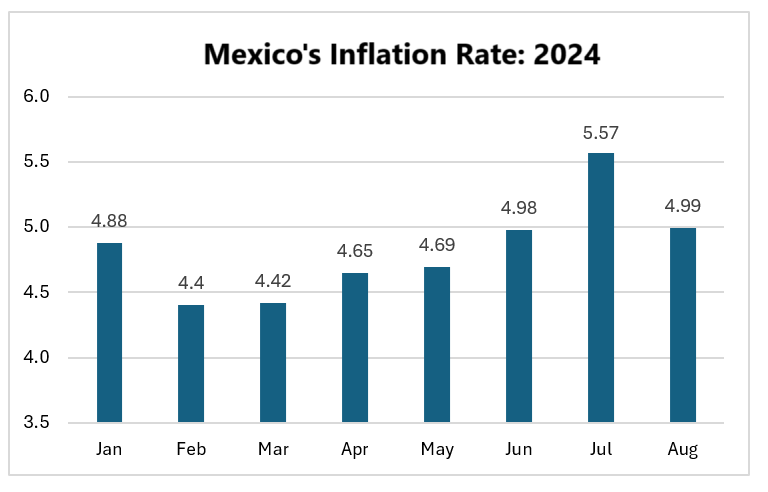

First, Mexico’s inflation rate worsened over the summer as compared to early 2024. Back in March when I last wrote about CETES, Mexico’s inflation rate was looking much better at around 4.4%. But from that point forward, things started to unravel.

Inflation shot back up to 5%+ over the summer months, as you can see in the table below.

Second, despite the inflation problem, Mexico’s Central Bank (known as Banxico) cut its benchmark interest rate twice in response to slowing GDP numbers. The cuts amounted to a half a percentage point decrease in the rate from 11.25% to 10.75%.

Third, as many of you already know, the peso has lost roughly 14% of its value against the US Dollar and Canadian Dollar since Mexico’s Presidential election last June.

Peso weakness stems not only from the Morena party’s overwhelming victory, but also due to the President’s subsequent move to radically alter how the judiciary functions (forcing judges to become politicians to retain their positions) and eliminating the judicial branch’s power to block the ruling party’s decisions.

These changes were viewed by foreign investors and neighboring governments as a blatant power grab and grave threat to the rule of law in Mexico.

Finally, the US Federal Reserve made a stunning move this week in cutting interest rates by half a percentage point despite inflation still being well above their official target. (core inflation readings for the last two months were 3.2%, or 60% above the Fed’s stated 2% goal.)

The Fed’s aggressive rate cut, combined with strong hints of more to come before year-end, sent Treasury yields falling across all maturities.

The Case for Buying CETES

So, let’s cut to the chase. Should you keep (or even start) buying CETES Bonds?

On balance, I think CETES remain a good choice for Mexican residents seeking a steady, low-risk source of passive income.

Why?

The parity in rate cuts by Mexico and the U.S. (half a point each) is neutral, but the spread between yields and inflation continues to favor Mexico.

In plain English, investing your funds in Mexican bonds better preserves the purchasing power of a resident’s cash than investing in U.S. Treasury bonds.

To use a simple example, if an investor buys a six-month CETES bond yielding 10.6% annualized while inflation averages 5% over that period, your real rate of return on the investment is a very respectable 5.6% (10.6% – 5%).

If the same investor chooses to buy a six-month U.S. Treasury bill instead yielding 4.5% annualized, the real rate of return is just 1.3% (4.5% – 3.2%).

For anyone living and spending most of their budget here in Mexico (and not looking to take on significant investment risk), buying CETES is a no-brainer.

Plus, it’s worth remembering that the Mexican government has never defaulted on CETES bond payments since they started selling them 46 years ago. CETES are considered the safest type of investment in Mexico.

And while that’s no guarantee it won’t happen in the future, with shorter holding periods (e.g. 1-3 months), your risk of loss due to default is very, very small.

With central bankers in both countries more concerned these days about economic growth than reducing inflation, investors need to take matters into their own hands to preserve their purchasing power and maintain their standard of living.

Is There More Risk Now Buying CETES?

Yes, there is indeed more downside risk than six months ago. Unquestionably, political risk in Mexico has risen following AMLO’s judicial reform gambit.

With the Morena party’s ambitions left unchecked, it raises the possibility of a rating downgrade for Mexican bonds from BBB currently (the lowest rating considered investment grade) sometime in the future.

Why is that?

During AMLO’s presidency, Mexico saw a big increase in government debt as a percentage of GDP, from 45% six years ago to almost 50% today. With the judiciary now incapable of stopping Morena’s big spending projects (no matter how ill-conceived) there’s less likelihood of self-restraint.

Rating agency Fitch expects Mexico’s debt levels to continue rising in the coming years, risking a tipping point.

With regard to the peso’s value, judicial reform changes are now priced in, but the outlook remains cloudy. Mexico will have a new leader on October 1, and the too-close-to-call U.S. election looms shortly thereafter.

This equals more uncertainty and likely more currency volatility. So expats thinking of investing new funds in CETES should do so with the intention of keeping this capital in Mexico.

In other words, I recommend using the proceeds to fund your spending in pesos, as converting those earnings to foreign currencies could wipe out all of your gains.