Just about everyone knows their money goes a lot further in Mexico when it comes to basics like tacos, beer, and bus fares. In percentage terms, these things are so much cheaper here than north of the border.

But in total dollars, those opportunities don’t add up to big money, at least not for your first few decades of living here.

So, where do the really big savings come from living in Mexico?

Drawing from my experience living in Guadalajara since 2022, I’ll explain where and how expats can save big, i.e. the kind of money that could be life-changing over 5-10 years. The cost savings are based on a comparison to my life in the U.S.

Veterinary Care

Ever since veterinary care in the United States became the playground of private equity firms, expenses to take care of Lola and Tinkers have gone through the roof. Some pet owners have been so burned by debilitating vet bills that they run up huge balances on their credit cards and go heavily into debt.

Some start GoFundMe campaigns, while others spend hundreds of dollars per year on pet insurance to avoid this predicament.

Last winter, my cat Nico suffered a urinary blockage here in Guadalajara. He became so sick that he needed to be hospitalized for seven days with round-the-clock care.

Our final bill, including diagnostic tests, surgical removal of the blockage, a week of hospitalization, pain medications, and round-the-clock feedings by vet techs, cost roughly USD $600.

I don’t want to make light of a USD $600 vet bill, because it’s a lot. At the same time, I shudder to think of what Nico’s health emergency might have cost us in the States…

USD $6,000? Crazy bills like that have become the norm there when pets have a health emergency.

Fortunately, Nico’s 100% recovered and back to his old self, hunting lizards and studying birds. While no one wants to deal with finding emergency vet care, in Mexico I know that a medical emergency for one of our animals won’t break us financially.

Auto Insurance

I’ve been astounded at the massive inflation in U.S. auto insurance policies over the past two years. In July 2024, the consumer price index (CPI) for U.S. auto insurance was up 19.5% year-over-year, with the two-year price increase a stunning 36%.

For the typical U.S. auto policyholder in 2024, paying USD $2,329 per year, that’s USD $600+ in additional insurance expenses since 2022.

While inflation hasn’t been tame over the past two years in Mexico either, you won’t suffer sticker shock like that when shopping for auto insurance south of the border.

Admittedly in Mexico, it’s far easier to live without a car, but there are still many places you will not be able to visit easily without one. (though it’s certainly doable if you’re determined)

For those who opt to keep a car in Mexico, you’ll be pleasantly surprised by how affordable auto insurance is, even with a high level of liability coverage. (always a good idea)

Last July when renewing the annual policy for our Ford C-Max, the premium increased to USD $469 in 2024 from USD $399 back in 2022. That equates to an 18% gain over the past two years, or USD $70 more.

So what if you don’t own a car or have pets in Mexico? Below are a few other living expenses where expats can reap huge savings.

Income Taxes

The Foreign Earned Income Exclusion (FEIE) for U.S. citizens is a mini-windfall for expats who are still working (for companies located outside of Mexico).

According to the IRS website, there are a few different ways for a U.S. citizen to qualify for the FEIE (anywhere in the world, by the way):

- Option #1 is to simply stay out of the U.S. for at least 330 days of the tax year and be able to document it.

- Option #2 is to be a “bona fide” resident of a foreign country for an uninterrupted period that includes the entire tax year.

We qualify through option #2, because we no longer have a residence in the U.S.

In 2024, the amount of earned income that can be excluded from U.S. federal taxes increased to USD $126,500 per person. For a married couple filing jointly, you can exclude up to USD $253,000 in earned income from your federal taxes.

That’s a pretty huge tax shelter!

Having the full amount excluded this year can save an expat roughly USD $18,000 in U.S. federal taxes, and more if your state taxes earned income too. A married couple claiming the full FEIE could save up to USD $29,000.

For an in-depth look at paying taxes as an expat, check out my previous post on this topic.

Property Taxes

If we still lived in our old house in Colorado, we’d be paying about $5,400 a year in property taxes. Now that we live full-time in Zapopan (west side of Guadalajara), our property tax bill is just $350 USD annually.

While our property taxes are ridiculously low in Mexico, we can lower them even further by paying the bill early. Since most locals take a mañana attitude to their property taxes, local governments incentivize property owners with a discount for payments in January or February.

In Jalisco, you can get 10% off your bill by paying before the end of February. But I’ve heard from expats living in Merida and Tulum that you can get as much as 30% off your bill if you pay before the end of January.

Have you ever heard of such a thing in the States?!

Bottom line… Our annual savings of roughly $5,000 on property tax frees up funds for more enjoyable things like travel — or investing to provide passive income and greater financial security. The choice is up to you.

For more details on paying property taxes in Mexico (known as predial) please check out my previous post.

Surgery & Hospitalization

It’s not just your cat who will reap the savings on health care. Medical care for humans in Mexico is also a source of huge savings, if you find yourself in need.

While no one hopes to have a major medical event, it’s a fact of life for most people sooner or later. If you need surgery, living in Mexico and lack Medicare (or any insurance) coverage, you could be far better off seeking care here than in the States.

This summer, I had an elective surgery at one of Mexico’s top private hospitals — San Javier in Guadalajara.

In 2024, my procedure in the U.S. would cost anywhere from USD 8,000-$19,000, depending on the location. At San Javier, my doctor’s bill came to $45,000 MXN, or USD $2,273 at the current exchange rate. It covered the surgical team, anesthesiologist, and lab fees.

Since I spent two days in the hospital recovering, I had a second bill for a private room, round-the-clock care from nurses, medicines, food, and other supplies. That bill totaled $37,000 MXN (USD $1,869 at current exchange rates). A similar stay at a private U.S. hospital could run as much as USD $4,000 daily.

I now understand why Guadalajara’s become such a popular destination for medical tourism.

Another great thing about medical care in Mexico is cost transparency. Unlike the States, where hidden charges, out-of-network fees, and other “gotchas” are commonplace after receiving treatment, in Mexico you must pay the hospital bill in full before leaving. It’s a one-time payment, with everything included.

My surgeon’s fee was also provided in advance — with no surprises when I received the bill. (though it’s certainly possible to pay more if you have complications)

This system can take a bit of getting used to (in a good way), especially for a country not known for transparency in general.

Besides the huge savings, there’s another benefit to being treated in Mexico. It’s what I refer to as a “culture of care.” Unlike most interactions with the medical community in the U.S., doctors in Mexico don’t treat patients like they’re running a business.

They take significant time with each patient and focus on their well-being, not the clock. Doctors will give you their personal mobile number and regularly work on Fridays (and even some Saturdays!). They will always (in my experience) answer WhatsApp messages on weekends.

And no, these practices aren’t outliers, but the norm.

Fine Dining

The foodies out there already know that fine dining in the U.S. (and Canada and Australia for that matter) has become a shockingly expensive post-pandemic. Food and beverage costs are up, while experienced help has become difficult to find due to a tight labor market, prompting restaurants to increase prices drastically.

Whenever we visit the States and dine out at a nice restaurant, the tab easily tops USD $200. For a truly special meal with fine wine in a coastal city like San Francisco or New York, plan on spending the equivalent of a Delta plane ticket. The cost of restaurant dining in the U.S. these days is mind-boggling.

On the other hand, fine dining in Mexico is still a relative bargain.

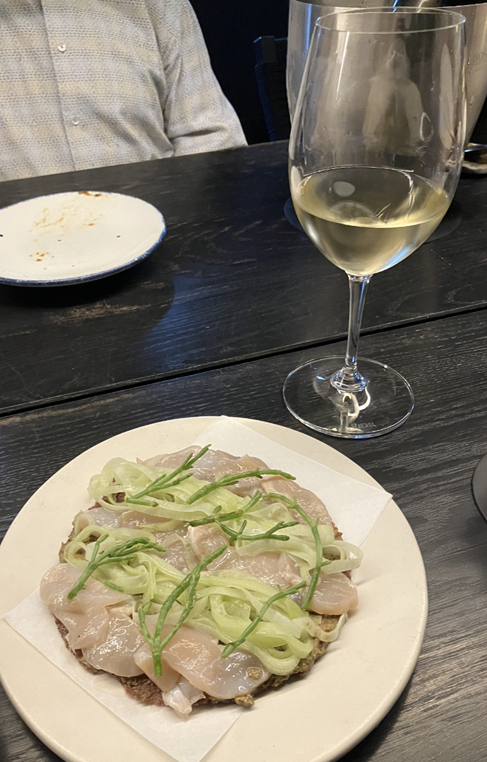

In Guadalajara, we’re fortunate to have several critically acclaimed restaurants with local chefs preparing innovative dishes in unique settings. One of our favorite places to dine here is Xocol.

Led by a husband-and-wife team, Xocol celebrates Mexico’s most iconic (and humble) ingredient: native corn. Its minimalist dining room is an unconventionally beautiful setting with corn husks hanging from the ceiling over a massive communal table, where diners enjoy camaraderie eating side-by-side.

Xocol has developed a serious following with international foodies. Earning accolades from critics at the Guardian and Travel + Leisure, as well as food bloggers and chefs who travel far and wide for a great meal, it’s an essential stop in Guadalajara for those who live to eat.

On our last visit to Xocol with friends visiting from NYC, we ordered (and devoured) nearly everything on their seasonal menu. In addition to the food, we enjoyed a lively Austrian white wine with mineral notes and vibrant acidity. (Xocol has one of the most interesting wine lists in a town known for Tequila)

When the bill arrived, our friend Gordon expressed disbelief. The total for 3 courses with wine per person, including taxes (but not tip), was USD $70.

“Is this right? he asked.

It was.

Incidentally, the next morning following breakfast at a chic cafe near our house, reverse sticker shock struck our friends once again when the bill was delivered. “I think they forgot to include something.”

They hadn’t.

Housing

This item may seem pretty obvious, but can’t be excluded from “big ticket” savings given its impact on the typical household budget.

When we sold our Colorado home in 2022, we were convinced we’d sold at the top of a housing bubble. And while prices have corrected somewhat in the West since then, they continue to hit new highs in many eastern U.S. cities.

Our trade worked out well, as we took the proceeds from our U.S. home sale and bought a modern, 3-bedroom, 3-bath house in a tranquil, walkable neighborhood in metro Guadalajara without taking on another mortgage. This was possible because our home in Mexico cost 60% less than the one we sold.

Pocketing the difference, we’re now able to earn investment income on those funds previously locked up in “shelter” costs. For countless U.S. households sitting on significant home equity in 2024, this opportunity still exists.

Even if you decide to rent instead, substantial savings are available in Mexico. Though housing costs vary massively from one location to another, it’s instructive to look at average rents in major cities like Guadalajara.

The average price for a 2 Bedroom/2 Bath apartment in Guadalajara is currently about $25,000 pesos (USD $1,276 at the current exchange rate) in 2024. And while it’s possible to find cheaper housing than that, you’ll have to sacrifice a bit on location and property condition. If it works for you, great.

According to Zillow, the median rent on a 2-bedroom apartment in Los Angeles (the 2nd l largest U.S. city) is currently around USD $3,000, which is down almost 5% year-over-year.

In this example, by moving to Mexico you could lower your housing costs by nearly 60%, and possibly more, depending on your needs.

What would you do with an extra USD $1,700+ in your pocket each month?

Maybe you’d work less and finally have time for a hobby you’ve had put on the back burner. Maybe you would pay down a lingering student loan, or begin investing to improve your financial security.

******

While you may not reap all of these savings, most expats benefit from at least a few of them. Besides, it’s helpful to keep in mind that these savings compound, year after year.

For some, living in Mexico offers an opportunity to dig out of debt and start building wealth to secure their future. For others, it’s a path to early retirement and the opportunity to enjoy their lives more fully, learn new skills, and give back to causes they never had time for when working so hard to make ends meet.