If you’re thinking about relocating to Mexico, save yourself a boatload of stress while protecting your cash by getting a few financial matters in order first. This post will discuss four smart money moves to make before you move to Mexico.

Before you can legally relocate, you must get qualified to live here by proving to the Mexican government that you have the financial means to support yourself.

Obtaining residency in Mexico. How much is needed to qualify gets asked all the time in online forums, but the thing is — these figures are a moving target, varying somewhat from one consulate to another. (this is just how things work in Mexico)

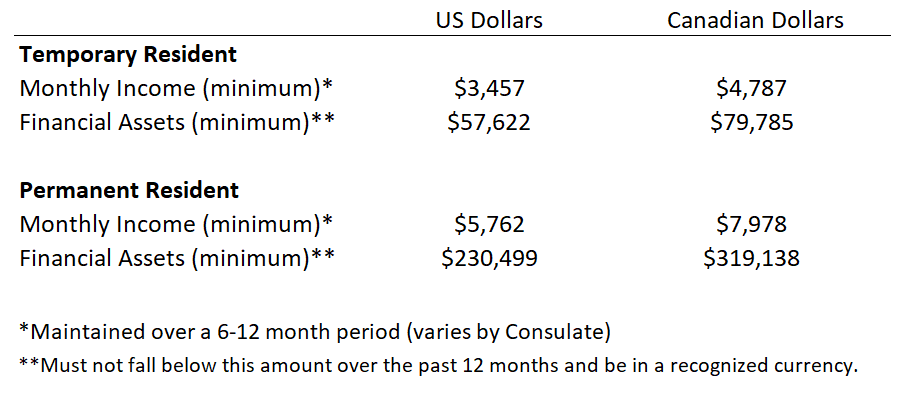

That said, the table below is representative of the requirements for single applicants in 2023. Note that most consulates seek to qualify people individually, not as a couple or family.

Financial Requirements for Individuals in 2023

Financial requirements for temporary and permanent residency are indexed to the Mexican minimum wage, which has been rising lately due to its strong economy and persistent inflation.

Crypto (any type) does not qualify when presenting proof of financial solvency to the Mexican government, nor do even less liquid assets like fine art, gold coins, or foreign real estate. Only hard currency will do.

The financial requirements for residency in 2024 went up by 20%.

There are other uncommon ways to qualify for residency, including owning a home in Mexico worth more than $16 MM pesos (for a couple) or investing in Mexican businesses above a certain threshold. Needless to say, these aren’t viable options for most people.

How To Be Financially Savvy When Moving Abroad

Once you receive the coveted residency visa sticker in your passport from a Mexican consulate abroad, you can start taking practical steps to prepare for the move.

My advice below is based on our experience relocating in 2022, along with lessons learned. These recommendations are made with the aim of:

-

- Minimizing transaction costs on international money transfers

-

- Eliminating your ATM fees in Mexico

-

- Avoiding foreign transaction fees on all credit card purchases

-

- Ensuring you have enough cash available to fund your initial expenses

Step 1: Learn How To Move Money Across Borders

This is key if you plan to maintain a foreign account after you move to Mexico, which is a good idea, at least for the first few years.

Transferring funds directly from a U.S. (or Canadian) bank to a Mexican bank is not recommended, because you’ll get hit with high fees that eat up your cash reserves.

How’s that, you ask? My previous post covers this topic in more detail if you’re interested.

In brief, the “old-guard” banks like Wells Fargo and Bank of America hit you with steep wire fees (~$30-35 USD) each time you make an international transfer. And this is on top of the huge margins they skim off the exchange rate transaction, ranging from 4% to 10%!

There’s just no reason to further enrich these fat cats with your hard-earned money. Fortunately, we now have plenty of alternative options to move funds across borders, rapidly and cost-effectively.

The vast majority of expats here in Mexico recommend using Wise to move money cost-effectively. I’ve also used Wise numerous times and never had a problem.

That said, my analysis this month found that Wise isn’t always the most efficient, as its fees have risen. If you’re watching every penny, you should check out their competitors.

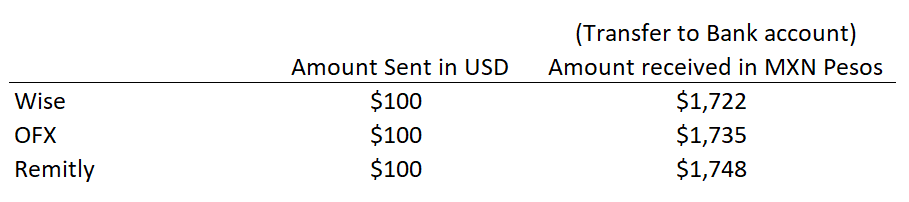

The table below illustrates how much a recipient in Mexico (you or someone else) would receive from a $100 USD international transfer, net of fees, from three popular providers.

Money Transfer Service Comparison from USD to MXN Pesos

As you can see, the best deal currently for a USD to MXN Peso transfer is with Remitly (quote provided via comparison engine Monito), followed by OFX.

Would this be the case across all currencies at all transaction sizes? Probably not. But it’s a good idea to do a quick check for yourself before making transfers of a significant size.

Step 2: Get a Credit Card with No Foreign Transaction Fees

Before moving to Mexico, I used to rely mainly on a Chase Visa card that imposed a 3% foreign transaction fee (FTF) in dollars on purchases made abroad. It didn’t hit me too often, and the cash-back was so attractive it more than made up for that inconvenience.

When I relocated, however, this card no longer made any sense. Switching to another card with no FTFs and no annual fee such as the Capital One Savor card saved us a lot of dinero.

Because card terms change constantly, it’s best to search for yourself on the best deals available.

Living in Guadalajara — a major city in Mexico where foreign credit cards are widely accepted at restaurants, supermarkets, gas stations, and large retailers — changing to a credit card with no FTFs has saved us an estimated $800-900 USD per year.

Step 3: Consider Setting Up a New Bank Account

I recommend having at least one account in your portfolio that refunds all of your ATM transaction fees. Again, this requirement is likely to steer you away from the traditional banks, who’ve never seen a fee they didn’t like.

The best solutions I know of aren’t traditional bank accounts at all. They’re cash accounts with brokerage firms like Fidelity Investments or Charles Schwab.

Setting up a cash account at either Schwab or Fidelity does require you to have a brokerage account as well, but it’s not like you’ve got to be active in the stock market to get one.

The brokerage account just needs to exist. At Fidelity, you can do this with a deposit of as little as $1, with no minimum balance or account fees. It doesn’t get much easier than that.

What’s the value of doing this? Let’s say you make a weekly ATM withdrawl at a local bank that charges a 46 peso fee per transaction. For reference this is what Banorte charges at most locations I use in Guadalajara.

Over a year, you’d lose around $128 USD if you didn’t have a foreign financial institution reimbursing you for all of those pesky fees. You could also lose a lot more if you regularly withdraw funds at Scotiabank or BBVA, where the fees are higher.

While losing $100-200 a year isn’t a financial disaster, it still buys a lot of ceviche!

Step 4: Build Up Your Emergency Fund

The last step you should take before moving to Mexico is to build up your cash cushion (aka “emergency fund”) to cover your living expenses in the first few months after arrival.

When you find a landlord willing to rent to foreigners (not always the case in Guadalajara), they often ask for several months’ rent up front, plus a security deposit (normally one month’s rent).

So it’s a good idea to be prepared with enough cash that you can easily land a nice place to live, and get out of short-term housing (at tourist prices) as soon as possible.

Whether you buy or rent, furniture and appliances are likely to be on your shopping list shortly thereafter, as nothing is typically provided by landlords or sellers.

And while you could take care of those needs with a credit card, buying these items second-hand (from digital nomads moving on) can save you a lot of money, but naturally requires cash.

What’s more, I’ve also found that many retail stores will give you a better deal if you pay all in cash instead of with a credit card. Smaller artisans (who do the best stuff) are also most likely cash only.

In most of Mexico, an emergency fund of at least $7,500 USD in cash should be sufficient for a couple’s first three months.

Final Thoughts

Do you need to set up a Mexican bank account too? This is debatable — and from my perspective optional.

I’ve lived in Guadalajara comfortably for a year and a half without one. However, there are times when having a local account would be much more convenient. For this reason, I plan to dedicate an entire upcoming post to the topic.