The past six months have been a rough ride for the Mexican peso. The currency has lost 15.7% of its value against the U.S. dollar during this period, closing yesterday at 20.17 — its weakest point since September 2022. NOTE: for this article all exchange rate quotes reference the USD.

For Mexican residents who fund their living expenses from dollar-based accounts (US or Canadian), these are interesting times. Our cost of living rides the roller coaster right alongside the peso.

Despite the peso’s recent weakness, it appears poised for more volatility in the weeks ahead, and possibly another leg down.

Why is the Peso Under Heavy Pressure?

Reason #1: Looming U.S. elections

Much of the financial world (which is often wrong) believes Donald Trump will win the U.S. presidential election next Tuesday, November 5. Poll jockeys say the race is now tied in crucial swing states, making the outcome of this monumental election as clear as mud.

Remembering what happened back in 2016 (which we’ll get into below), currency traders have been reducing their exposure to the peso lately – preferring to hold dollars until the election is over.

This week, peso selling intensified, with the Mexican currency breaking through the psychological barrier of $20 to the dollar on Monday — and holding at these levels in subsequent days.

Back in 2016 when Trump won his first race for the presidency, the peso dropped 12.4% overnight, from 18.6 to 20.9. But that wasn’t the end of it.

The peso fell another 5% to $22 in January 2017 when Trump was sworn into office. Soon after, it stabilized and then recovered much of what it had lost over the next six months.

Why 2024 May Be Different from 2016

If Trump wins, a repeat of this pattern is certainly possible. But I’d argue there is far more downside risk to the Mexican peso in the current U.S. election cycle compared to 2016.

Why you ask? Trump’s policy proposals towards Mexico are far more extreme in 2024 than anything he’s said or tried previously.

They include:

- Slapping huge tariffs on Mexican products imported into the U.S.

- Deporting millions of undocumented immigrants, some of whom are Mexicans.

- Taking direct military action against Mexican drug cartels on Mexican soil to disrupt the drug trade.

Trump has promised to impose new tariffs on goods imported from Mexico. They include across-the-board taxes of 10%-20%, with levies on Mexican-built autos as high as 200% (a penalty meant to hurt Chinese-owned businesses operating in Mexico).

Steep tariffs like these would devastate bilateral trade, as the U.S. took 83% of all Mexican exports last year, valued at $529 billion last year according to the U.S. Dept of Commerce. They would also bring nearshoring (foreign investment in Mexican manufacturing capacity) to a screeching halt, and plunge Mexico’s economy into a deep recession.

And while I’m sure many Mexicans would love to see fewer of their prized avocados headed north, this proposal (effectively a trade war with Mexico) is nothing to wave away as mere campaign bluster.

In addition, Trump has promised to deport millions of undocumented migrants from U.S. soil, which would further weaken the peso. A lesser-known driver of peso demand is the massive volume of repatriated funds by overseas Mexicans to their families back home.

If huge numbers of undocumented Mexican workers were expelled from the U.S.– repatriated funds from the U.S. to Mexico would also plummet, further depressing peso demand. And because repatriated funds represent essential income for millions of Mexican families, it would depress commercial activity south of the border too.

Now mass deportation is no small thing. It would require significant funding from the U.S. Congress to pull off — making it far from certain even if Trump wins. But a Republican-controlled Congress could make it happen, with time and motivation.

The last proposal — Trump’s desire to take military action against Mexico to stem the drug trade — is so preposterous that few political observers have taken it seriously.

But it’s difficult to discount entirely given Trump’s open admiration of Vladimir Putin’s invasion of a peaceful neighboring state. Plus, Trump’s promise to pack his next administration with loyalists makes extremist policies more feasible if he returns to office.

If Harris wins, we would likely see some reversal of fortune for the peso. Her policies would bring more consistency and stability to bilateral relations with Mexico that the markets (which hate uncertainty) would quickly embrace.

Reason #2: Mexico’s economy continues to slow

Besides U.S. election risks, Mexico’s economic numbers are looking shakier as the year progresses.

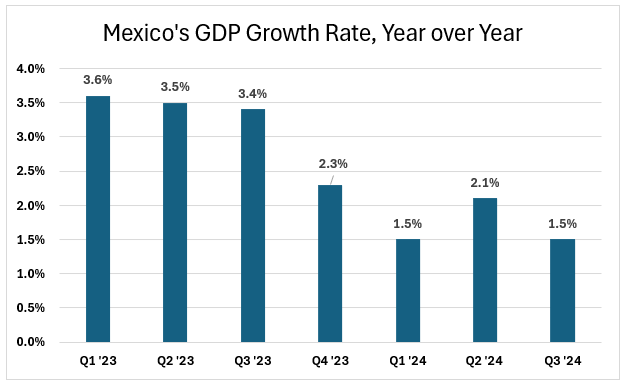

For the third quarter ending in September 2024, Mexico’s economy grew at a 1.5% annualized rate, missing the Finance Ministry’s target of 2.4%. This was down from 2.1% growth in the second quarter.

Additionally, the IMF now expects Mexico’s GDP to grow just 1.5% in 2024 (down from 2.2% previously), with further slowing to 1.3% in 2025. Depending on how the U.S. election turns out, their estimate for next year could still be optimistic.

Anecdotally here in Guadalajara, we have seen a lot of businesses running promotions lately, which is outside of the traditional sale periods that Mexican retailers adhere to pretty tightly. It reinforces the government’s data suggesting that consumer spending has slowed markedly in recent months.

A weaker Mexican economy increases the odds of deeper interest rate cuts by Banxico in 2024, which could pressure the peso even more. The only thing complicating this picture is Mexico’s inflation rate – which reaccelerated in early October.

Meanwhile, U.S. economic data is considerably stronger. Following the Federal Reserve’s deep half-a-point rate cut in September in response to weakening labor market data (which was used to justify the cuts), the data were revised upward by the government. Oops!

Plus, American consumers continue to spend with abandon and the U.S. stock market remains near record highs. Taken together, additional interest rate cuts by the U.S. Federal Reserve are far less likely in 2024.

These dynamics all suggest a strong U.S. dollar may continue.

Reason #3: Controversial Moves by Mexico’s Ruling Party (Morena) Just Keep Coming

President Claudia Sheinbaum has doubled down on radical judicial reform initiated by her predecessor during her first month in office. The changes require Mexican judges to be elected by popular vote instead of being appointed.

According to new reporting, 8 of Mexico’s 11 Supreme Court justices will resign in 2025. These judges, affiliated with opposition parties, have decided against becoming politicians in races they would almost certainly lose given Morena’s tight grip on Mexican electoral politics right now.

Judicial changes continue to worry foreign investors, as established rights and laws are less secure when those who decide court cases are routinely subject to a popular vote.

Recent energy reforms backed by President Sheinbaum have also raised eyebrows. Earlier this month la Presidenta pushed through a constitutional change declaring Pemex (in oil) and CFE (in electricity) “public state companies” going forward.

They were already public entities so the change may not sound like a big deal.

However, the new legal status of Pemex and CFE guarantees them both a dominant position in their respective markets — regardless of their future operating costs, energy output, or carbon footprint.

With the state-owned companies’ track record for dirty, inefficient, and money-losing practices, it’s another sign that the new president isn’t serious about modernizing Mexico’s energy sector or ensuring competitive markets.

The status changes for CFE and Pemex also concentrate even more power in the ruling Morena party’s hands – causing many to question Mexico’s commitment to operating as a market economy.

My 80-year-old neighbor Hector is even more blunt. He grimaces when declaring the “Communists” have taken over Mexico.

None of this has helped the peso.

How to Take Advantage of Peso Volatility

While there are no guarantees when it comes to future exchange rates, it still pays to be prepared. For those funding their lifestyle in Mexico from foreign currencies like the U.S. dollar, Canadian dollar, or Euros, recent volatility represents an opportunity to lower your expenses.

Currency traders are bracing for wild swings in the peso/USD exchange rate in the coming weeks. But you don’t have to be a financial pro to capitalize on the peso’s volatility.

There are free tools for making cross-border currency transfers when the peso hits a desired level. Wise is one of the best.

If you already have a Wise account, simply log in and scroll to the bottom of the homepage to the “Do More with Wise” section, as shown below. Click on the “Auto convert” card to set a “strike price” for currency conversion when your desired exchange rate is available.

If the target exchange rate is hit, your funds get transferred. If the rate isn’t reached, nothing happens and the funds stay in your bank account.

It’s that simple. Wise ensures you don’t miss an opportunity while you’re asleep, working, on a jog, or doing whatever else fills your days.

If you don’t have a Wise account, you can open one in minutes. Their multi-currency accounts can be used 24/7 on a computer or your mobile phone to take advantage of favorable exchange rates.