Unlike life in the U.S. these days, Mexico is still a very cash-oriented economy. This is true whether you are living in a huge city like Guadalajara, or a smaller town like Chapala. Mom and pop grocers, street market vendors, and taco shops are likely to be cash only.

And no matter how many pesos you hand-carried down on the plane, bus or in your personal vehicle, you’re soon going to need to replenish your stash.

Accessing pesos when you need them is frankly really easy in most parts of Mexico. There are just as many banks with ATMs, known locally as cajeros automaticos, as in the States in major and mid-sized cities, or anyplace with a sizable tourist market.

The trickier part is knowing where you’ll get the best deal, as it’s not terribly intuitive.

As a rule, you do not want to exchange dollars in the airport, as vendors there know they have a captive audience and typically do not offer the most competitive rates.

This is also true at the international money changers you find scattered around busy downtown neighborhoods. As a rule, they offer pitiful exchange rates, taking a commission of 5% or more on each transaction. The closest money changer to my house in Guadalajara is Centro Cambiario Delfino located inside Plaza Patria; and I have never seen a rate offered there approaching what I can get from an ATM.

By far the best way to get pesos from your U.S. or Canadian bank account is the ATM machine at the branches of major banks such as BBVA, HSBC, Santander, Banorte, Scotiabank, CitiBanamex, and the like.

For the newly arrived, there are two things to watch out for when getting money from an ATM.

1. Avoid using any ATM that requires scanning your card to enter the premises. A popular scam criminals used to steal bank card info is to install a reader on the scanners, and account-holders that use them can become victimes of data theft. Fortuntely, this scam is much less common in 2023 than it was 5+ years ago; but it’s still something to be aware of when selecting which ATM to use.

2. Decline the Bank’s conversion rate on your transaction. While the transaction fee charged by the bank to use their ATM – which ranges anywhere from $30-$100 pesos ($2-6 USD) – cannot be declined, you can almost always decline the bank’s exchange rate conversion when withdrawing money. Doing this will cost you much less than accepting it.

Let’s look at a concrete example to see how Mexican banks rip off unsophisticated ATM users.

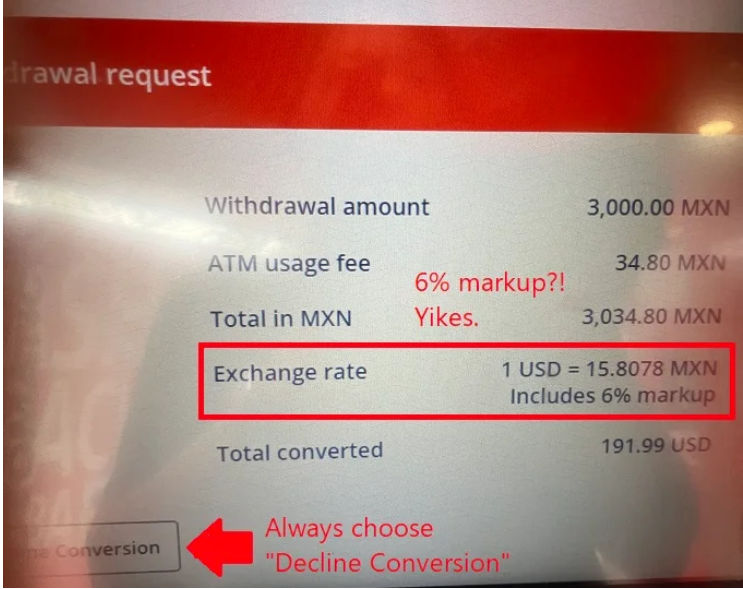

Two weeks ago I was at a Santander Bank ATM in Zapopan to withdraw $3,000 pesos. I agreed to the transaction fee of $30 pesos (you MUST accept the bank’s fee to withdraw money), and next am asked whether I’d like to accept the bank’s exchange rate of 15.8078, which includes a commission of 6%.

The Exchange Rate Conversion Screen at Santander:

If I choose “yes”, it says my Fidelity bank account will be debited $191.99, based on Santander’s exchange rate. Instead, I chose “Decline Conversion” in the lower left and still receive 3,000 pesos from the machine, with the exchange rate provided by Fidelity instead.

Many visitors and new residents falsely assume that the transaction will be declined if they say no to the bank’s exchange rate. NOT TRUE!

Later that day I login to my Fidelity account to verify the transaction details, where it shows that my account was debited $181.76, translating to an exchange rate of 16.70 ($3,034.80 divided by $181.76).

By declining Santander’s conversion rate I saved myself $10.29 USD on a single withdrawl! Over a period of months, those fees can really add up.

Most Mexican bank ATMs will feature something similar to Santander. And if you’re not being asked this question during an ATM withdrawl (this happened to me at Citibanamex while visiting Taxco last week), I recommend trying a different bank next time as you won’t know for sure what exchange rate will be used—and you may receive a poor exchange rate.

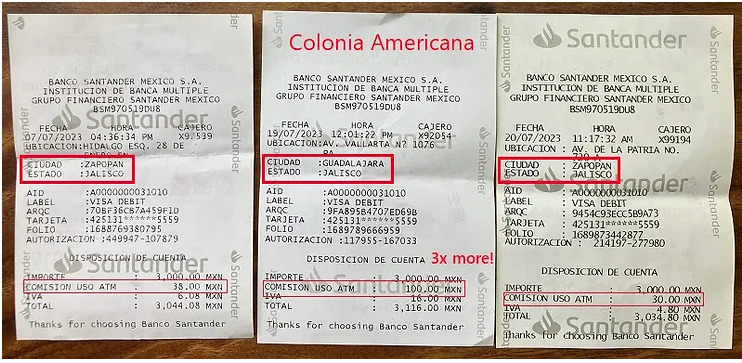

Another thing I noticed recently is that the various Santander branches around metro Guadalajara charge wildly different fees on an identical $3,000 peso withdrawl. Is it any surprise that the tourist and expat heavy Colonia Americana branch charges ATM users more than triple the commission of the Zapopan branches a few kilometers west?

The easiest way to neutralize these costly fees is to set up an account with a foreign bank that reimburses all transaction fees on ATMs such as Charles Schwab or Fidelity Investments.

Getting a bank account at either Schwab or Fidelity does require a brokerage account as well, but it’s not like you have to be an active stock trader to get one. The brokerage account just needs to exist – and can be opened at Fidelity with a deposit of as little as $1, with no minimum balance or account fees. Definitely worth your while!

Another way to eliminate these transaction fees is to open a checking account with a Mexican bank. However, keep in mind that Mexican banks are far more likely to charge account management fees as they do very little lending compared to U.S. banks. As such, fees on account holders are a key way they make their money.

As a foreigner, opening a Mexican bank account is also not as simple as it once was, so we’ll dedicate a future post to this topic.